ASEAN – CAN ASEAN RISE TO THE OCCASION?

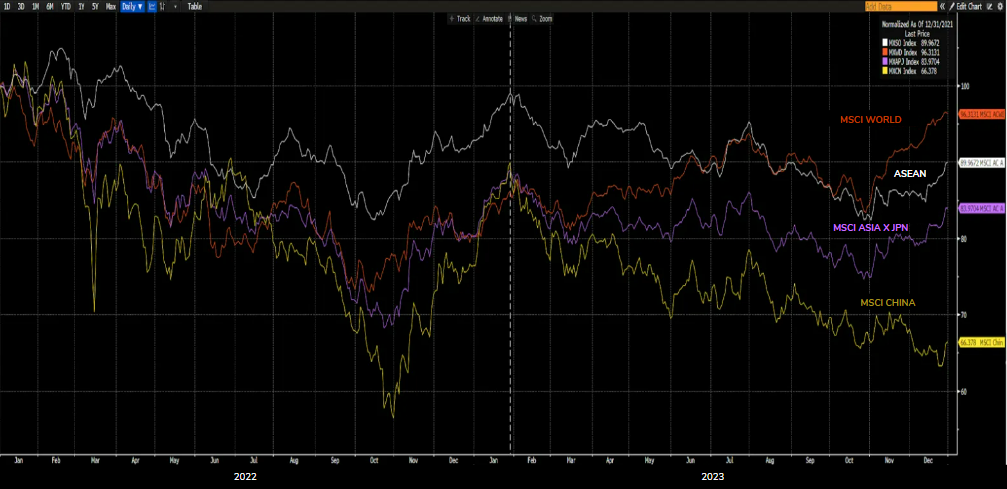

Figure 1: Performance since 2022 – ASEAN, ASIA (MSCI Asia x Japan), WORLD (MSCI World), CHINA (MSCI China)

2024 - ASEAN, A SAFE HABOUR

BETTER ECONOMIC GROWTH

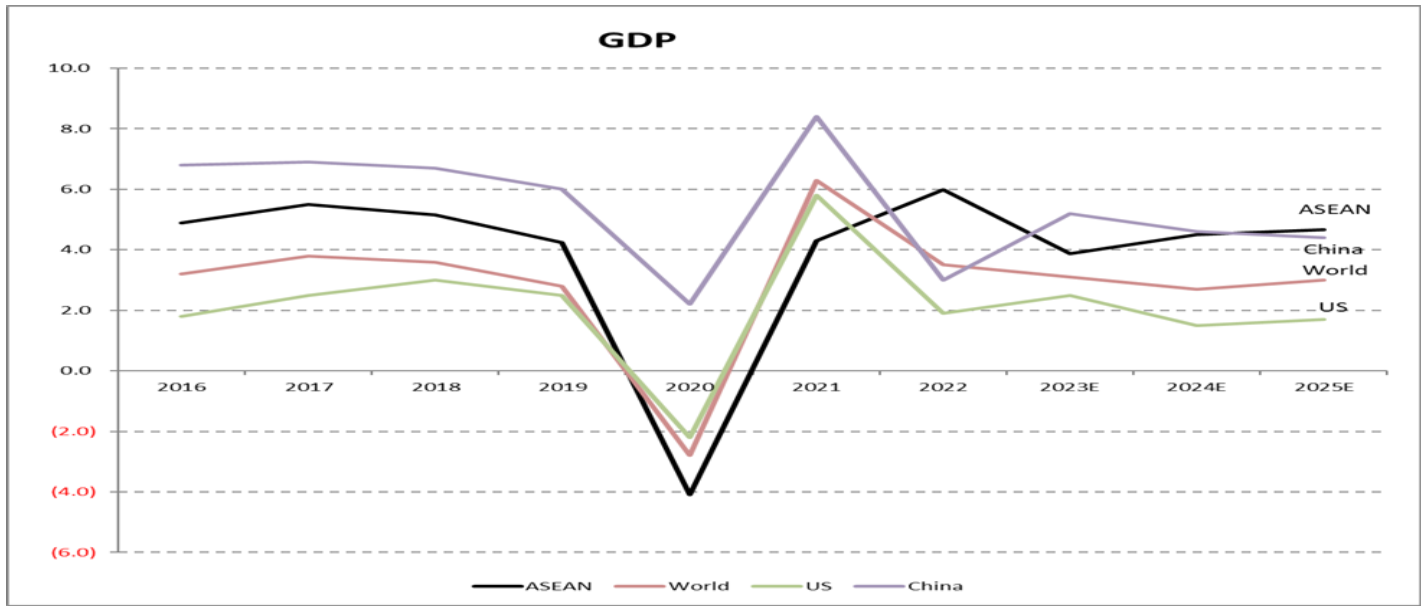

Global GDP growth is expected to moderate to 2.7% in 2024 after expanding 3.1% in 2023 based on Bloomberg estimates. However, ASEAN is expected to do better with sequentially stronger GDP growth of 4.5% in 2024 from 3.9% in 2023, reflecting among others, policy measures to boost domestic economy and emerging signs of turnaround in manufacturing output and exports.

Figure 2: ASEAN-6 GDP vs World

Source: Bloomberg as at Jan 24

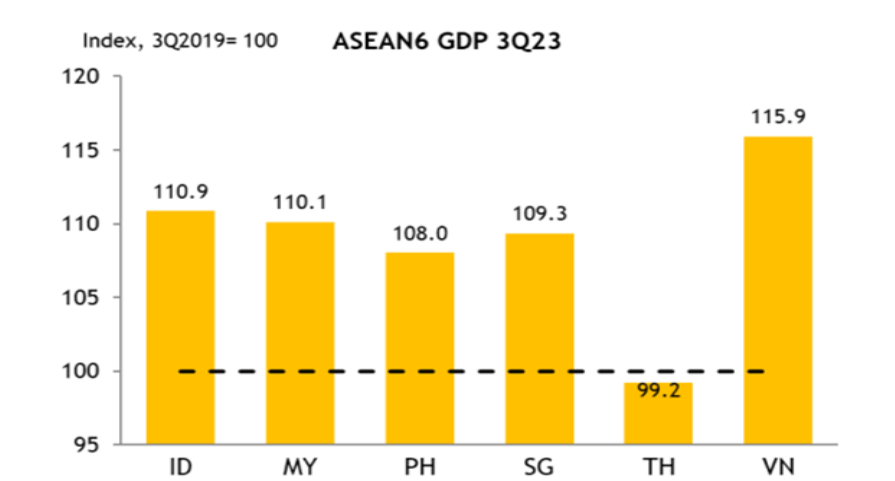

ASEAN-6 GDP has already surpassed pre-pandemic levels in 3Q23 with the exception of Thailand, as pent- up demand for services post-pandemic drove the economic growth recovery. With service demand normalising in ASEAN, domestic consumption, government fiscal spending and recovery of the manufacturing sector would be key drivers of ASEAN’s GDP this year. There are nascent signs that green shoots are appearing in manufacturing and exports in ASEAN as several ASEAN PMIs (Purchasing Managers’ Index) have reverted to expansion (PMI > 50) and certain export data has begun to turn around.

Figure 3: ASEAN-6 GDP has surpassed pre-pandemic levels in 3Q23 except for Thailand

Source: CEIC, Maybank Research as at Dec 23

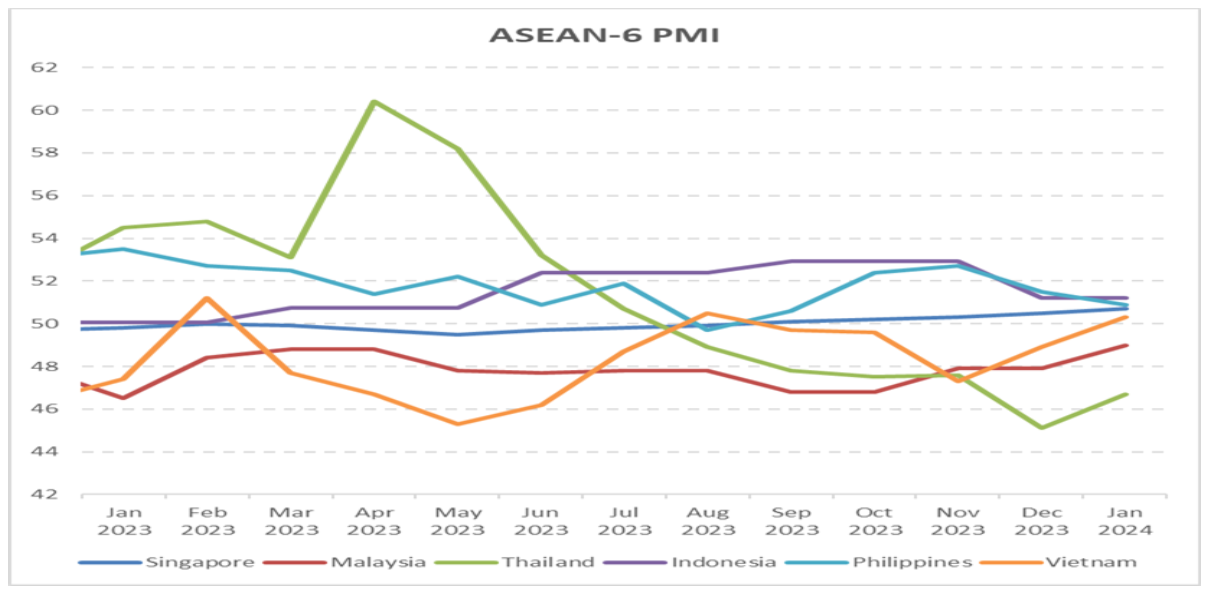

Figure 4: ASEAN PMI

Source: Bloomberg as at Jan 24

The improvement in manufacturing and exports as indicated by the PMI is partly attributed to technology and electronics replacement cycle, aggressive US fiscal spending and generous subsidies especially in semiconductor and electric vehicles, bottoming of chip and commodity prices and rising Foreign Direct Investments (FDIs) into ASEAN.

These should benefit the trade-dependent economies of Singapore, Thailand, Vietnam and Malaysia. At the same time, growth in domestic-oriented Indonesia and Philippines are expected to remain resilient. As a result, all the countries in ASEAN should see stronger sequential GDP growth in 2024 compared to 2023.

STRONGER CURRENCY FROM INTEREST RATE CUTS

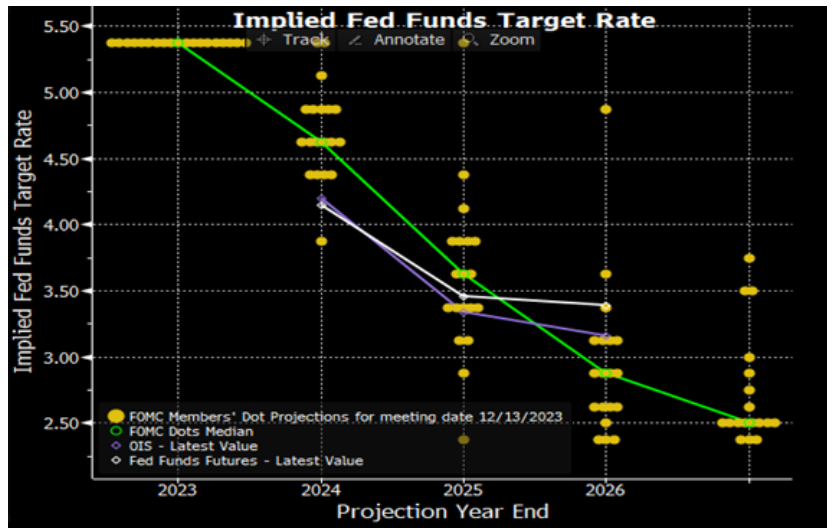

Inflation rates globally have already peaked since 2022 and are moderating. Correspondingly, global interest rates have also peaked with most central banks pausing rate hikes and signalling potential interest rate cuts. Based on current expectations, the Federal Reserve (Fed) is expected to cut interest rates by 75bps. It is only a matter of time before rates get cut as the market narrative has now shifted to “when will rates be cut”.

Figure 5: US Fed Dot Plot

Source: Bloomberg as at Jan 24

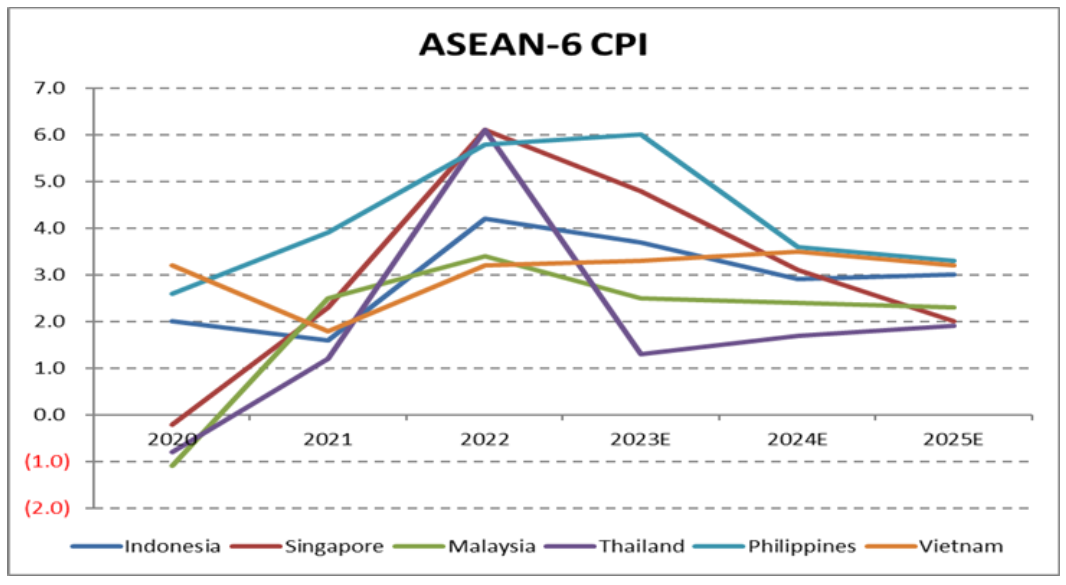

Inflation in ASEAN has also fallen since 2022 and it is expected to moderate to around 3% in 2024 from 3.6% in 2023.

Figure 6: ASEAN Inflation

Source: Bloomberg as at Jan 24

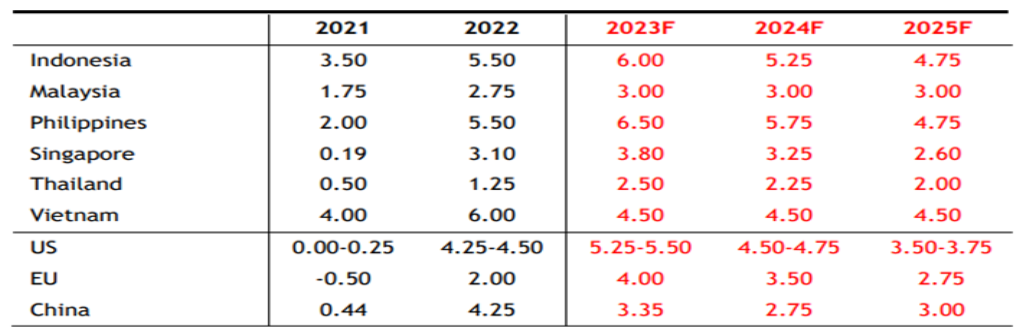

With inflation falling to within the comfort zones of most ASEAN central banks and following the lead from the Fed, the expectations are that ASEAN central banks will also be looking to lower their benchmark interest rates. This should result in lower borrowing costs and better valuation premium in ASEAN. In addition, we expect the USD to weaken as the Fed cuts interest rates which would see ASEAN currencies strengthen against the USD. This should also result in more inflows into ASEAN markets.

Figure 7: ASEAN & Major Economies Monetary Policy Rate Forecast

Source: CEIC, Maybank Research as at Dec 23

RECOVERY OF INTERNATIONAL ARRIVALS AND TOURISM

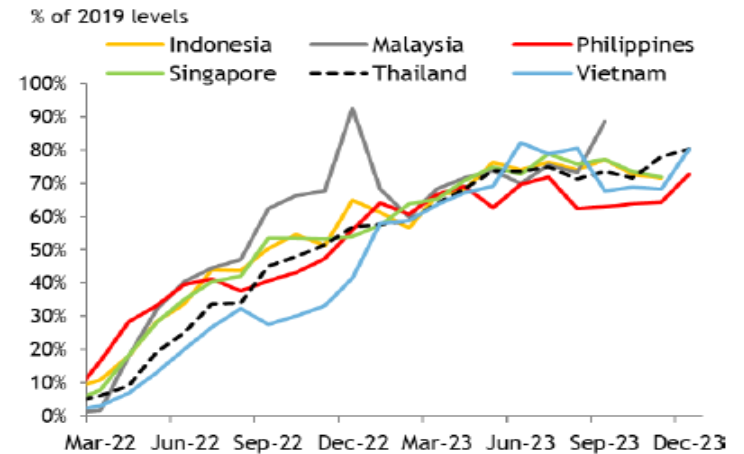

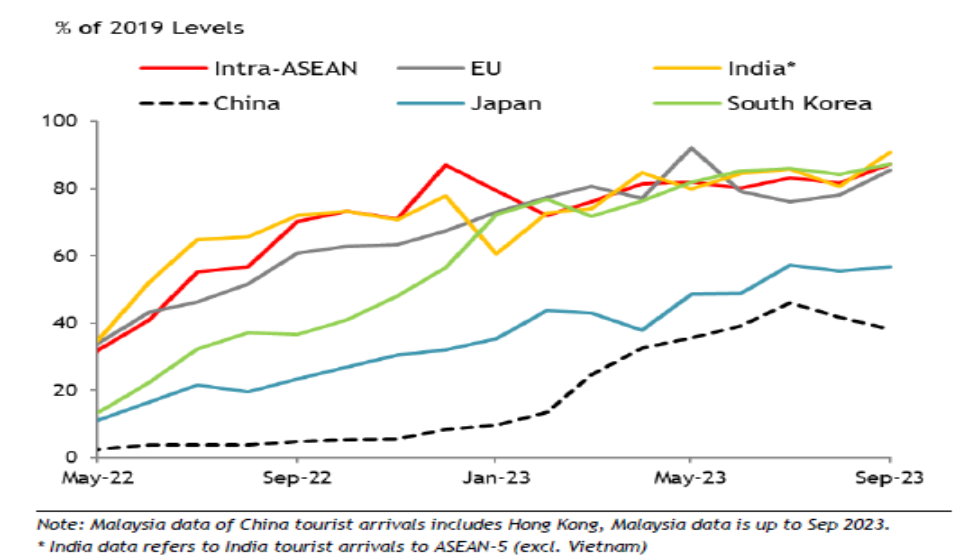

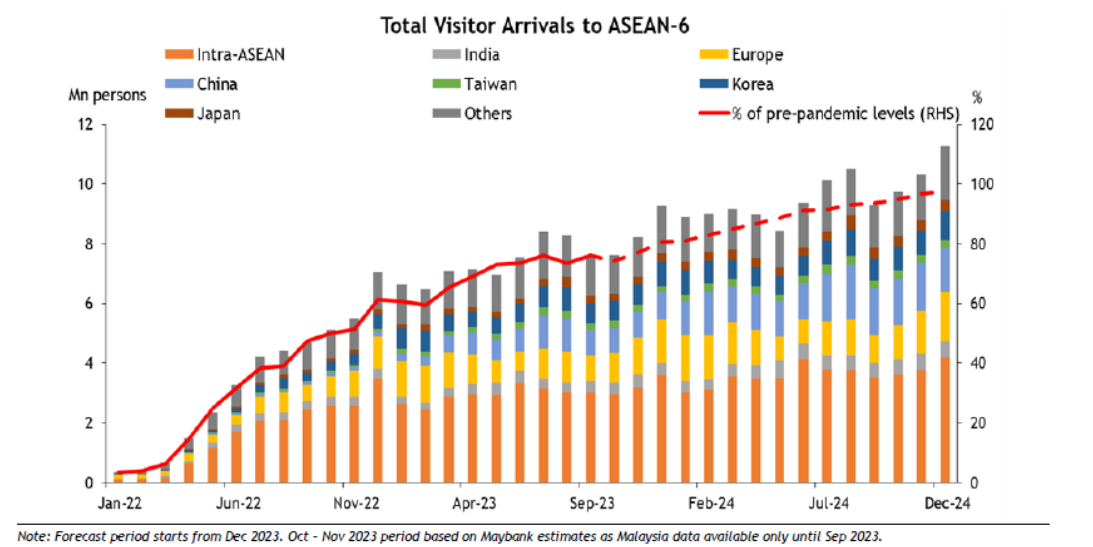

Visitor arrivals to ASEAN have recovered back to around 70-80% of pre-pandemic 2019 levels by end of 2023.

Figure 8: Total Visitor Arrivals to ASEAN-6 Members

Source: CEIC, Maybank Research as at Jan 24

However, the visitors from China to ASEAN have been below expectations with recovery rate of less than 40% of pre-pandemic levels. This was attributed to various reasons such as availability of flights from China, visa application difficulties and weak economic conditions in China.

Figure 9: Visitor Arrivals to ASEAN-6 by Source Country

Source: CEIC, Maybank Research as at Jan 24

In 2024, the expectations are for visitor arrivals to fully recover to 2019 pre-pandemic levels by year end, based on Maybank Research estimates.

Figure 10: Total Visitor Arrivals to ASEAN-6 Projected by December 24

Source: CEIC, Maybank Research as at Jan 24

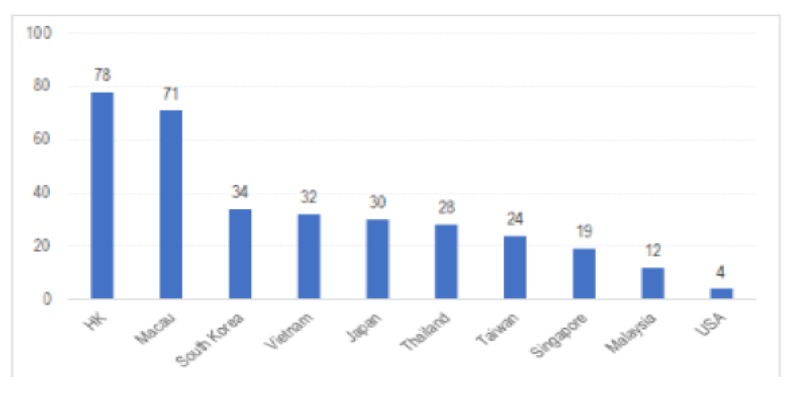

The key driver for this recovery will depend on the recovery of the Chinese visitors as they account for a significant portion of ASEAN inbound visitors especially Thailand, Singapore and Malaysia.

Figure 11: Chinese Visitors as % of Total Visitors for the 2019 Top-10 Destinations

Source: Citi Research as at Jan 24

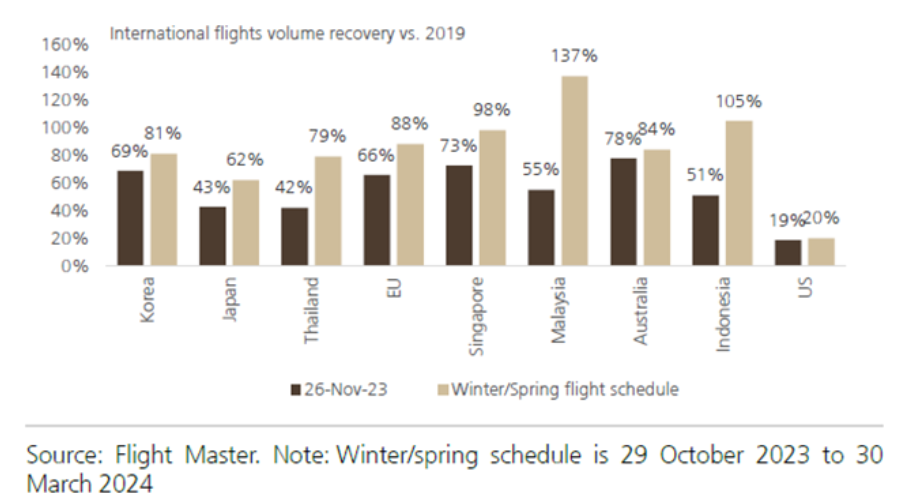

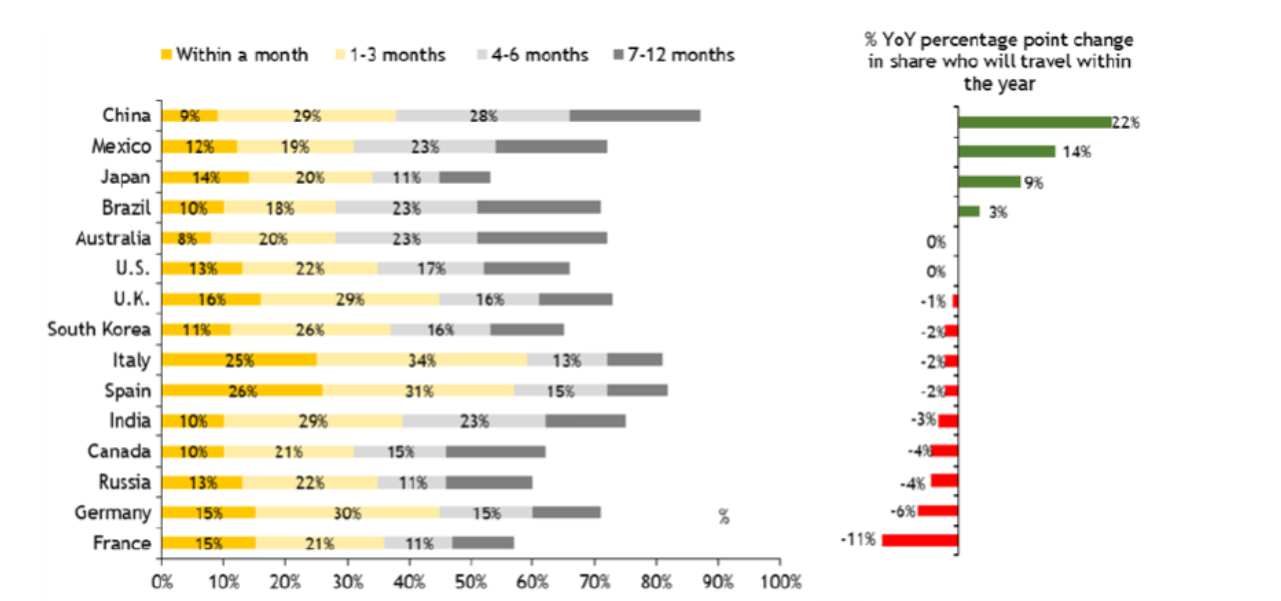

As flight capacity from China improves and visa free program initiated recently between China and 3 ASEAN countries of Thailand, Singapore and Malaysia, we expect Chinese travellers to ASEAN to recover this year. Recent surveys also showed that the propensity to travel for Chinese travellers over the next 12 months remain high.

Figure 12: China International Flight Volume Recovery by Country

Source: UBS Research as at Jan 24

Figure 13: Adults in Each Country Who Said When They Would Travel Next for Leisure

Source: Maybank Research as at Jan 24

POSITIONING

We remain positive on ASEAN in 2024 as we believe ASEAN can provide a safer haven for investments amid potential volatile global conditions. We are positive on companies that are beneficiaries of domestic growth driven by improving economic conditions, consumption, government fiscal spending and more FDIs into the region. We are also favourable to some of the companies that should benefit from the continued recovery of in-bound tourism into ASEAN. We remain invested in selective companies in the consumer, technology, clean energy and industrials sectors that are expected to capture some of the secular trends of rising middle income, adoption of technology and clean energy transition in ASEAN.

*All data are sourced from Lion Global Investors and Bloomberg as at Jan 2024 unless otherwise stated.