From an Earnings-driven market to a Returns-driven market

For over two decades, investors in the Japanese stock market have had to deal with the volatility of corporate earnings as well as the fluctuations in the currency, which at many times, had a strong correlation. Companies had a strong tendency to preserve and accumulate capital, especially during uncertain times, most of the time at the expense of shareholders’ returns, and only rewarded shareholders when there were exceptional profits.

As a result, investors had a strong inclination towards companies that demonstrated the ability to generate high profitability and growth.

However, since early 2023, when the Stock Exchange initiated steps to push companies to improve their capital efficiency and corporate value, it has since become an unstoppable juggernaut that has taken a life of its own, with activist investors, foreign and domestic institutional investors, retail investors, proxy voting advisors and even regulators all pushing for better corporate governance and shareholders’ returns.

Corporate management, once comfortable in their cocoon of friendly investors from cross-shareholdings and passive minority shareholders, have been forced to take measures to show investors they have their interests at heart, both in the performance of the shares and in shareholders’ returns such as dividends and share buybacks.

While the situation started as one of forced action, having now seen the positive impact of such actions on both the share prices and management stature, many corporate managers have now embraced the notion of corporate governance and shareholders’ returns.

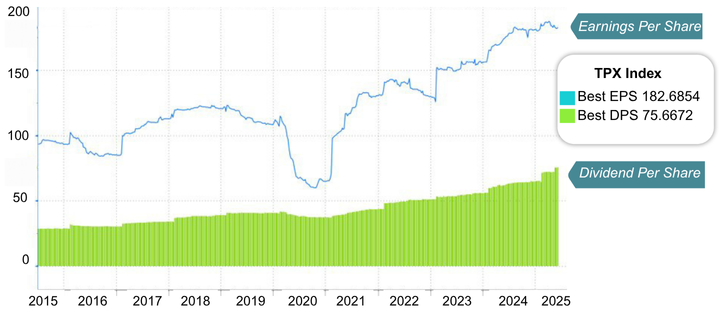

The effect of this change in this mindset is that companies have made stable and rising shareholder returns one of the key priorities, with many companies setting minimum dividend levels regardless of profits as well as hiking dividends annually as a target, regardless of earnings outlooks.

Companies Hike Dividends Despite Uncertain Outlook

Another highly positive effect is that companies now seek to dispose of previously unutilized assets such as idle land or cross shareholdings as well as non-core businesses to convert into cash for growth investments or return to shareholders. Such actions can raise the value of companies considerably and the success of companies disposing of such assets has prompted others to follow suit. At the same time, activist investors have become motivated by the success of pressing management into such reforms and such activism is growing rapidly, pushing more companies into action.

Understanding the Market Shift

With the ongoing structural change in the Japanese stock market, it is slowing turning from an earnings-driven market to a returns-driven market. The type of investors who participate in the market may also be changing in the foreseeable future. There is a high possibility that investors who previously made short-term bets like the infamous Yen-carry trade (shorting the Japanese Yen and buying the Nikkei 225 Index) may gradually be replaced by longer-term investors who value stable returns. This relative stability will likely improve the risk-return dynamics of the market and further attract investors to the market.

This structural change in the market is especially important in the context of the current highly uncertain and unpredictable geopolitical climate where the world is becoming increasingly polarized.

Corporates and investors alike have to navigate in this environment. As companies provide stability in returns to investors, investors are less likely to be fickle and the capital market remains stable, allowing for rational decision-making. Such a market environment could provide a safe harbor for investors.

Our LionGlobal Japan Growth Fund and LionGlobal Japan Fund both seek to participate in the ongoing corporate reforms and improving shareholder returns at Japanese corporates. In particular, we focus on companies that have the ability to combine sustainable growth with enhanced shareholders’ returns.