.png)

Navigating the impact of Fed rate cuts on your bond portfolio

From rate hikes to retreat, buckle up for a volatile, and yet a potentially rewarding ride in the 2024 bond market. Thanks to the disruption during the pandemic, the realignment process to a stable economy came with the pain points of the Federal Reserve (Fed) aggressive monetary tightening cycle which began in March 2022. In its efforts to cool inflation, the Fed funds rate was increased by 5.25% during this period. The Fed’s recent pause in the rate hikes combined with the market’s anticipation of rate cuts have become a pivotal moment where bond vigilantes are injecting optimism into the market.

So, herein lies the question: pause or cuts, how would one position their bond portfolios with the Fed cutting rates in 2024?

Interest rate View

In the December 2023 Federal Open Market Committee (FOMC) meeting, the Fed's Chair, Powell indicated that the current policy is at or near the sufficiently restrictive stance that they have long sought after. The Fed has also started discussions on the amount of rate cuts required going forward. The median dot in the December 2023 Summary of Economic Projections (SEP) anticipated 75 basis points (bps) of rate cuts in 2024. The bond markets, are anticipating further cuts by the Fed and are pricing in 150 bps of cuts in 2024.

Inflation

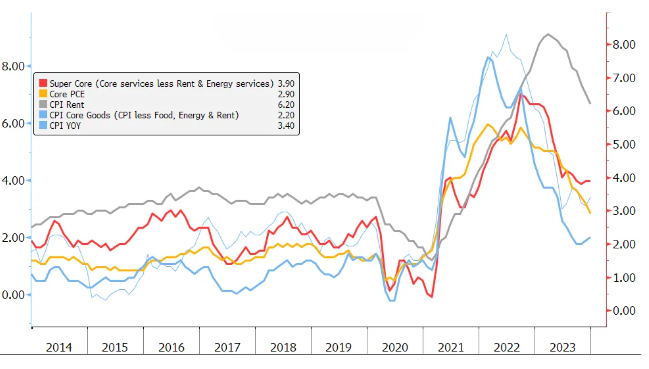

The US economy started to respond to the aggressive tightening policy implemented by the Fed since their first hike in March 2022, aimed at arresting the spike in inflation that arose as global economies emerged from the pandemic. The combined 5.25% hike in US Fed Funds rate has driven US CPI (Consumer Price Index) to drop from 9% in March 2022 to 3.1% in November 2023. Core PCE (Personal Consumption Price Index), Fed’s preferred measure of inflation, has dropped from more than 5% in May 2022 to just above 2.9% in December 2023. This is expected to trend lower to the Fed’s target of 2.5% around mid-2024.

Figure 1: Fed's Core Inflation Indicators

Source: Bloomberg, 26 Jan 2024

One key reason inflation has fallen is the normalisation of the job markets from mismatches and disruptions during the pandemic. As economies emerged from the pandemic, businesses had to realign their staffing requirement which resulted in significant tightness in the job market. This imbalance between labour supply and demand is currently healing as workers and employers adjust to the new equilibrium. This has resulted in weakening US employment, with vacancy to job ratio declining quickly from its peak.

Along the same vein, the restoration in supply chain issues gave further impetus for inflationary pressures on goods to dissipate.

Positioning for 2024

The lower inflation prints in end 2023 has led to a bull steepening of the US yield curve with yields at the front end of the curve falling more as markets are pricing in Fed cuts.

While inflation might prove to be sticky going forward, we think the Fed is on track to achieve their target to tame inflation. With this backdrop, we believe that bond markets will perform in 2024 with investors potentially benefiting from the yield curve re-inversion by staying in the front end of the yield curve with high quality bonds. With the bond market currently pricing 6 cuts this year against 3 cuts telegraphed by the Fed, buying long dated bonds runs the risk of market repricing this optimism.

Investing in Short-dated Investment Grade Bonds: Demand exceeding supply

The shortage of high-quality bonds in the corporate bond market provides a technical bid for bonds, offering investors a support for bond prices. Demand for bonds should improve going into a Fed easing cycle. As the Fed cuts in 2024 translate to lower money market rates, we believe investors would shift their interest to short-dated corporate bonds. Investors currently parking their funds in bills with attractive rates will have to seek alternatives as money market rates drop in tandem with the Fed cuts. A natural alternative would be to move into short-dated safe instruments such as 3-to-5 year Investment Grade bonds.

The supply of USD Investment Grade corporate bonds is currently low as issuers have not been tapping the bond market as much in the last few years. In 2023, the net supply of USD Investment Grade bonds was US$546 billion (-14% Year-on-Year (YOY)) and it is almost half of 2020's issuance of US$1,054 billion (Source: Barclays, US Investment Grade Debt 2023 Outlook). In the SGD corporate bond market, the shortage of bonds is even more dire as Singapore issuers have not been coming to the market while any supply of corporate bonds is quickly mopped up by real money accounts like insurance companies and asset managers.

Improving Credit Fundamentals

Credit quality of large Investment Grade companies have improved with their leverage decreasing. Over the past 5 years, more than half of the top 50 corporate issuers from the Barclays US Investment Grade Index have reported decreased leverage. More importantly, these companies’ strong balance sheets provide sufficient comfort as global economies are heading into a potentially weaker growth environment.

In addition, with rates being reset significantly higher compared to last 2-3 years, these high-quality issuers would be mindful of higher interest cost and therefore would be restraining themselves from increasing their debt levels. Companies are also sitting on significant cash and termed out maturities. These factors bode well for limited supply going forward.

Valuations

Figure 2: 3-year BBB bonds. Yield Trading at 5.0664%.

While credit spreads are at near tight levels, we do not think levels are excessively rich. From an absolute yield perspective, we find yield levels attractive with 3-year BBB bonds trading around 5.06% (Refer to Figure 1). For Singapore investors, factoring in a hedging cost of 1.5% translates to a yield of 3.5%. In the SGD corporate bond space, we can find bonds with a yield of 3.5 to 4% (As of 26 Jan 2024).

USD bonds are also becoming attractive for non-US investors as the cost of hedging USD into these investors’ currencies are getting cheaper as US rates drop. For example, with the Fed cutting rates and the Bank of Japan hiking rates, the cost of hedging USD to JPY will drop.

Bonds are also trading at attractive levels when compared against equity. In the US, government bond yields are 2% higher than equity yields (as of 26 Jan 2024), which are attractive compared to a 10-year historical average where both yields are at par. Investors are paid a higher yield for investing into government bonds.

Conclusion

Although the markets have been priced in on the Fed’s rate cuts, the timing and the extent of the Fed’s rate cuts can significantly impact bond prices. Overall, we believe that an environment of lower rates, slowing growth, start of monetary policy easing and attractive all-in yields provide good reasons for investors to position in short-dated high-quality Investment Grade bonds.

*All data are sourced from Lion Global Investors and Bloomberg as at 26 Jan 2024 unless otherwise stated.