Earlier this year in our Fixed Income Market Outlook, we had mentioned how investors could position themselves with the upcoming rate cuts. It has just been over a year since the Federal Reserve (Fed) has halted its rate hike. In its efforts to tame inflation in the economy, there had been a total rate hike of 5.50% from March 20221 till end July 2023. The markets have been anticipating rate cuts and for the longest time it was only a question of when the Fed was expected to cut rates that weighed on many investors.

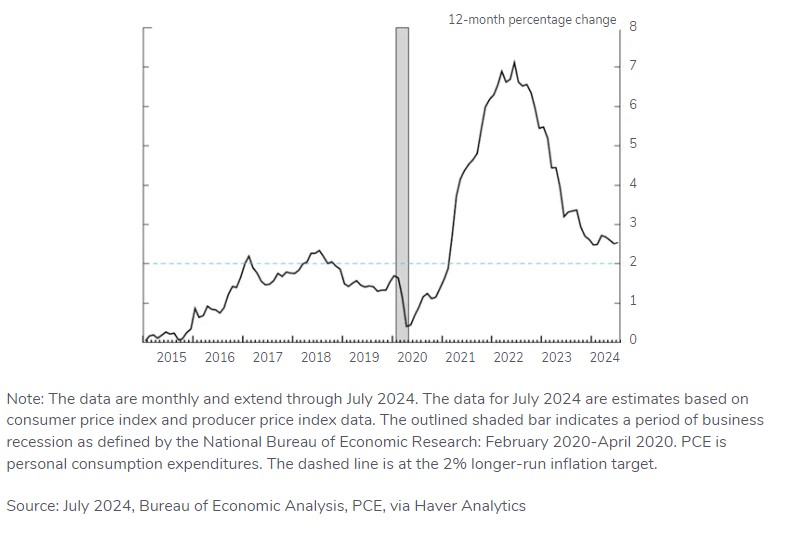

The recent CPI (Consumer Price Index) data released at end July indicated that inflation is at 2.9% and the Fed’s preferred measure of inflation, PCE (Personal Consumption Expenditures Price Index) is at 2.5% which is the lowest since March 2021.This has provided the markets confidence that the inflation will ease to the Fed’s 2% target and that the Fed will be cutting rates soon in the upcoming FOMC (Federal Open Market Committee) meeting in September.

The minutes from Jackson Hole has also confirmed the first rate cut in September and highlighted that the policy rate would give the Fed ample room to respond to any risks such as the weakening of the labor market. The August jobs report will provide further clarity if the Fed were to cut 50 basis points in September. With that said, the markets are anticipating the Fed to cut up to 100 basis points by the end of 2024.

Figure 1: Monthly US Inflation Rate: PCE (Personal Consumption Expenditures Price Index (%)

The Fed’s Influence on Singapore’s Interest Rates

The actions taken on by the Fed tend to cause a ripple effect to the rest of the world. Unlike most central banks today which conduct monetary policy by changing domestic interest rates, Singapore’s central bank, MAS (Monetary Authority of Singapore), does not control domestic interest rates. MAS conducts monetary policy by managing the Singapore dollar exchange rate against a basket of currencies from major trading partners to maintain price stability2.

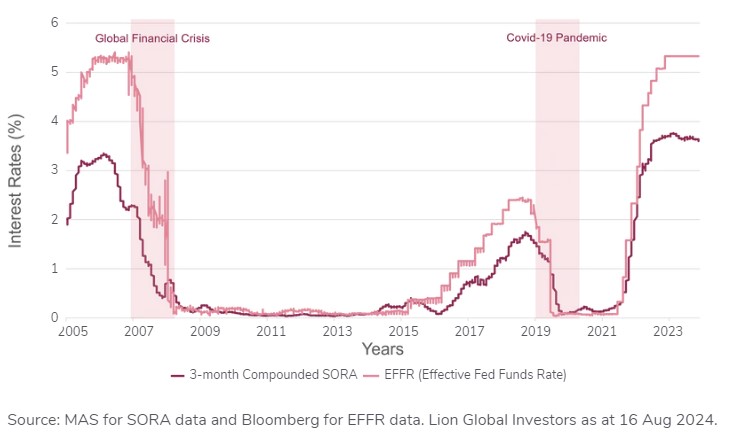

This policy causes Singapore’s interest rates to be greatly influenced by global markets and more so by the US market. The chart below indicates how Singapore’s interest rates or SORA (Singapore Overnight Rate Average) tends move in tandem with US Fed Fund rates or EFFR (Effective Federal Funds Rate). However, it trends slightly lower than US Fed Fund Rates. (See Figure 2)

Figure 2: Comparison chart of 3-month SORA and US Fed Fund Rates (EFFR)

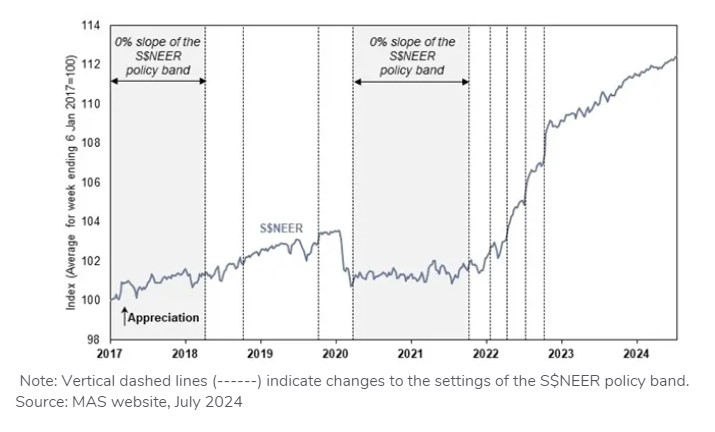

MAS relies on the currency exchange rates and a trading band called S$NEER (Singapore Dollar Nominal Effective Exchange Rate) to stabilize prices and manage inflation in the economy. Since October 2021, the MAS has implemented five rounds of tightening before pausing policy adjustments in 2023. As of 26th July 2024, MAS has maintained its monetary policy stance unchanged for the fifth consecutive time, reflecting a steady approach amidst ongoing economic and inflationary pressures. MAS's recent policy statement indicates that they will continue with the current rate of appreciation for the S$NEER policy band, with no changes to its width or level. Thus, leading to Singapore interest rate being lower than the US interest rate by 1.5% to 2%.

Figure 3: Historical chart of changes in MAS’ monetary policy stance and developments in the S$NEER

Yield Curve Dynamics

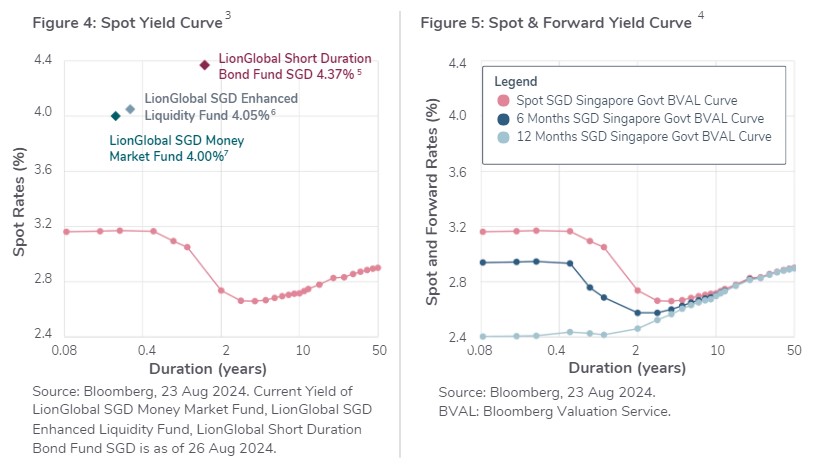

The forward yield curve indicates the expected future interest rates. The yield curve has been inverted since July 2022, making this the longest lasting inversion historically. An inverted yield curve, where short-term rates are higher than long-term rates, often signals economic concerns, though it has not yet led to a recession.

With the upcoming rate cuts, we can expect the yield curve to re-invert and become positive. This means that the short-term rates would decline and be lower than long-term rates. As global interest rates decrease, the short-term rates or SORA will decline in tandem. This is where investors could take advantage of current yields of short-term bond funds before it decreases further.

Positioning with Fixed Income Solutions

Anticipated rate cuts are likely to normalize the yield curve, transitioning it from its current inverted state to a more positive slope. This adjustment could create a more favorable environment for investors. If SORA aligns with global rate trends and short-term rates decline, positioning oneself in fixed income solutions like the LionGlobal Short Duration Bond Fund SGD or LionGlobal SGD Enhanced Liquidity Fund in the near term could be a strategic move, benefiting from current yields before they potentially decrease. For investors who are more risk-averse and looking for stable returns and capital preservation amidst volatility, positioning with the LionGlobal SGD Money Market Fund would be suitable.

1Source: CNBC, July 2024

2Source: MAS Website, July 2024

3Spot rate/Spot curve is today's yield curve.

4Forward rate/Forward yield curve is the market’s expectation of the yield curve in the future.

5In local currency yield terms and on unhedged Foreign exchange basis.

6Amortised cost basis, hedged back to Singapore Dollar.

7Amortised cost basis. Hedged back to Singapore dollar basis. Inclusive of cash & equivalents at a yield of 0%.

All data are sourced from Lion Global Investors and Bloomberg as at 26 August 2024 unless otherwise stated.