Decarbonization is not a moral imperative, it’s an eventuality and an opportunity

Nature will eventually force the world to do what it has been delaying for too long – decisive actions to reduce greenhouse gas emissions

The future is unequivocally low-carbon, driven not by election cycles nor by choice but by forces of nature.

Decarbonization is not a moral imperative, rather it is an eventuality. Businesses that recognize this and adapt early stand to gain a competitive edge – it’s a business opportunity, not (just) a moral imperative.

Consider the renewable energy sector. Solar and wind power are not just environmentally friendly; they are becoming some of the most cost-effective energy sources worldwide. Electric vehicles (EVs), once a niche market, are now disrupting the automotive industry. In sectors like construction, green building technologies are gaining traction, driven by both environmental considerations and long-term cost savings.

At Lion Global Investors, it is clear to us that the low carbon future is an opportunity, leading us to launch the Lion-OCBC Securities Singapore Low Carbon ETF (SLC ETF). It is the first low carbon ETF in Singapore and provides diversified exposure to the top 40 Singapore companies with a lower carbon footprint.

Singapore, where decarbonization never stops

It may seem that the decarbonization trend is stalling, if we go by the news headlines coming out from US media outlets.

But what happens at home, matters more than what happens in America. In Singapore, the government remains committed to the sustainability agenda.

For instance, Singapore announced on 12 Nov 2024, that it will commit up to US$500 million to a national initiative to channel financing to decarbonise Asia. On 10 February 2025, Singapore further announced that it would further reduce its emissions to between 45 and 50 MtCO2e in 2035, which is ~20% lower versus the 2030 target of 60 MtCO2e.

In the recent Singapore Budget, the government announced a series of initiatives such as a S$5 billion (bn) top-up to the Future Energy Fund, a S$5 bn to-up to the Coastal and Flood Protection Fund, additional climate vouchers for households to purchase more energy-efficient products, and initiatives to boost adoption of clean heavy vehicles, amongst other things.

All these goes to show Singapore’s commitment to the sustainability and decarbonization agenda. It also means that decarbonization opportunities remain well and alive in Singapore.Singapore is forging ahead, even as others are not. What happens at home, matters more than what happens in America.

Investing in Decarbonization: Live in the present, but invest in the future

If you invest in the present, you’re going to get run over

We might live in the present, but we should invest in the future. And investing in decarbonization is a way to future-proof our investments.

For individuals and institutions alike, decarbonization presents an interesting investment opportunity. Transitioning to a low-carbon economy requires massive capital, creating opportunities in renewable energy, energy efficiency, electric mobility, and beyond. The rise of green bonds, sustainable ETFs, and ESG-focused funds allows investors to align their portfolios with the future of the global economy.

A diversified basket of stocks or ETFs can mitigate risks while capturing growth across multiple sectors.

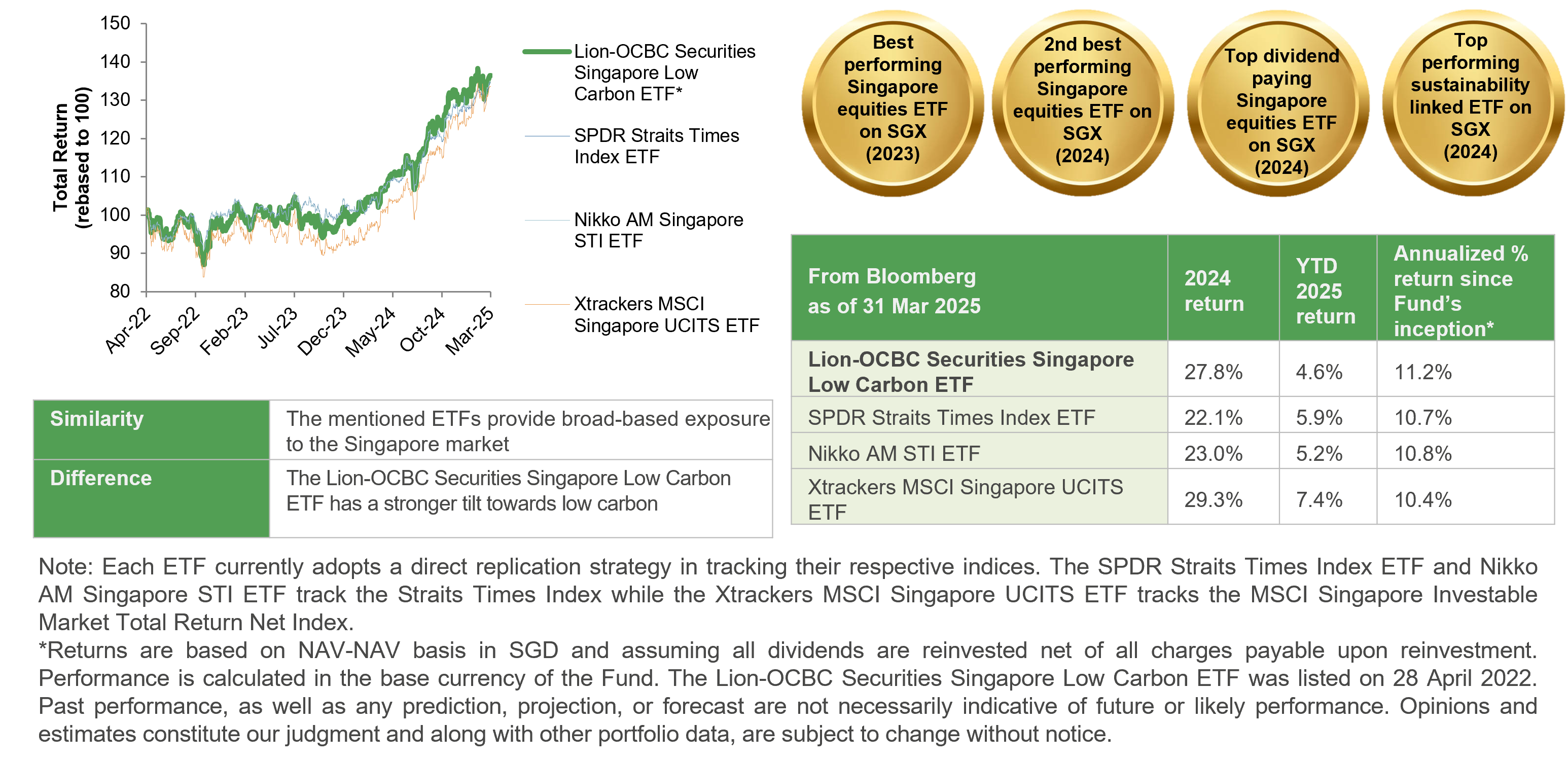

Take for instance, the Singapore Low Carbon ETF (SLC ETF), which provides diversified exposure to Singapore corporates with a lower carbon footprint. In 2024, the Straits Times Index (STI) had a blockbuster year with total returns of 23.5%, but the iEdge-OCBC Singapore Low Carbon Select 40 Capped Index, which the SLC ETF tracks, trumped that with total returns of 28.3%.^

The SLC ETF is the best performing Singapore equities ETF on SGX since listing (Chart 1)^^. Additionally, it is the top dividend paying Singapore equities ETF on SGX in 2024, with a dividend yield of 5.7%^^^Chart 1: Performance relative to other Singapore-focused ETFs*^^

^ Source: Bloomberg, as of 31 Dec 2024.

^^ Source: SGX and Bloomberg, as of 31 Dec 2024

^^^ Source: SGX 4Q2024 ETF Market Highlights. Past performance is not necessarily indicative of future performance.

Conclusion

Decarbonization is more than a response to the climate crisis. It is a transformative opportunity to reshape industries, spur innovation, and create lasting value. Whether through business strategies or investment portfolios, embracing decarbonization is not (just) the right thing to do, it’s the smart thing to do.

Invest in SLC ETF – Singapore’s Top Green Leaders. All in One ETF.