As Singapore celebrates its 60th year of independence, its equity markets also brought along cheer in 2025, outperforming both regional and global equities. As part of a series of measures to revitalise the Singapore Equity Market, the MAS has also announced a S$5 billion Equity Market Development Programme, that would inject liquidity into the equity market beyond large-cap stocks, sparking renewed local investor interest.

Structual Thematics Supporting Growth

We follow on from our previous video to highlight three structural thematics that support the structure growth of Singapore equities, namely: Global Safe Haven, Globalising Hub and Global City.

Figure 1: Structural Thematics Supporting Growth in Singapore equities

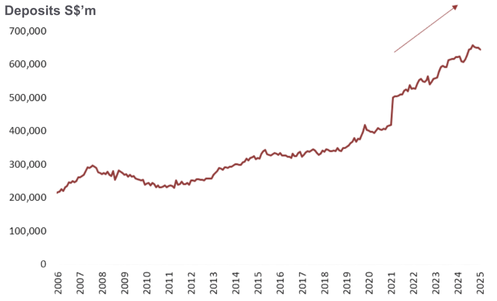

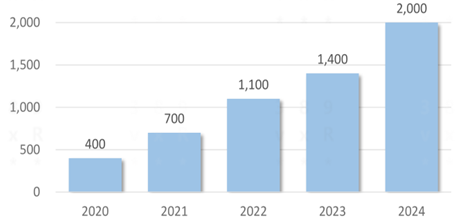

Global Safe Haven: Singapore’s rising status as a global safe haven has been a key megatrend driving its market outperformance. A strong Singapore dollar and a flight to safety amidst global uncertainty have attracted increasing amount of foreign funds into the Singapore’s financial system, whilst the Singapore Equity Market continues to offer improving dividend yields and attractive valuations. Therefore, as long as geopolitical uncertainty continues to define the remainder of this decade, we believe global flows will continue to provide tailwinds for the Singapore Equity Market for sustainable period of time.

Figure 2: Cumulative Deposits in Singapore banking system

Figure 3: Number of Single-Family Offices in Singapore

Globalising Hub capturing realignment of Supply Chains: Singapore companies are also becoming more Globally relevant, being geographically well-positioned to capture shifting trade flows amidst a post-tariff world. Sectors such as Industrials (which include Marine, Aviation, Power & Utilities), as well as Technology firms, AI Data Centres and Consumer brands are well-positioned to capture both regional and global demand.

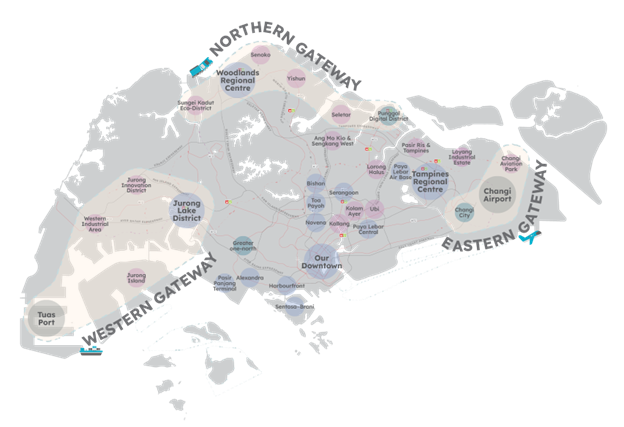

Global City Finally, Singapore’s aspiration to continue to grow in size as a Global City offers many opportunities for domestic companies, particularly in the construction, real estate and consumer sectors. We look forward to the 2030 URA Masterplan to provide more details of how these sectors can benefit from the development of Singapore’s physical and socioeconomic infrastructure.

Figure 4: URA Masterplan Gateways and Linkages to external markets

Market Revitalisation Initiatives

The Equity Market Development Programme is a timely initiative designed to support small and mid-cap (SMID) enterprises as these companies contribute to Singapore’s position as a Global Safe Haven, capturing opportunities from the shifting Global supply chains, and driving its growth as a Global City. This initiative not only enhances liquidity into SMID enterprises, but perhaps more importantly, to offer a signal of confidence for global funds to continue to invest in a deeper and more robust Singapore Equity Market.

Conclusion

We believe that the momentum of the Singapore Equity Market can continue to ride of the success of the past year. Singapore’s improving status as a global safe haven continues to attract liquidity from the top down, whilst SG60 has also brought about market revitalisation initiatives by the MAS from the bottom-up. This combination augers well for the prospects of the Singapore market.

All data are sourced from Lion Global Investors and Bloomberg as at 5 August 2025 unless otherwise stated.