The recent market volatility unleased by Trump’s Tariffs on Liberation day have created uncertainly in global financial markets. These tariffs, aimed at reducing trade deficits and reshoring manufacturing, led to concerns that such moves could push the US economy into a recession while causing inflation to spike. While the resultant drop in equity markets was expected, the spiked in US Treasury yields (drop in bond price) was surprising as typically investors are driven to hide in risk free assets such as US Treasuries.

One reasoning was that the tariffs have also led to fears of retaliation from trading partners like China and the EU, who could reduce their holdings of US Treasuries. This could have contributed to a rise in Treasury yields, as selling pressure increases and confidence in US government debt erodes. Additionally, the unpredictable nature of these policies has made US assets appear less of a safe haven, prompting investors to seek alternatives.

In addition, Trump's criticism of Federal Reserve Chair Jerome Powell and contemplation of firing him, have raised concerns about the independence of the US central bank. The Federal Reserve's independence is a cornerstone of investor trust in US Treasuries, as it ensures monetary policy is free from political influence. By questioning this independence, Trump has introduced uncertainty into the financial markets, giving investors further reasons to sell US Treasuries.

This combination of factors—geopolitical tensions, inflation concerns, and diminished trust in US economic stability—has driven the sell-off in USD assets.

This is evident in Figure 1 showing the recent behaviour of the yield on the US 10-year Treasury and the USD Index (as represented by DXY Index).

Figure 1: US 10-Year Treasury and the USD Index

Source: Bloomberg, 2 May 2025

In normal periods, lower yield on US Treasuries would lead to a weaker USD (and vice versa). This relationship was recently broken (red circle) when a weaker USD corresponding with rising US yields. This is a result of money flowing out of USD assets, reflecting a loss of confidence in USD assets.

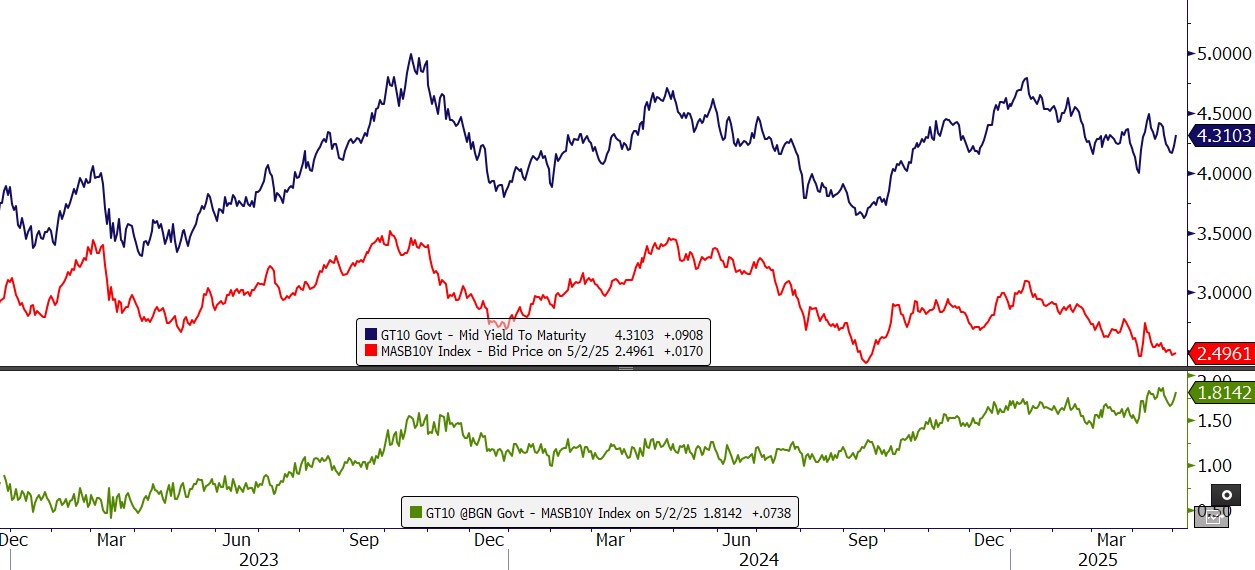

A similar behaviour is seen in the relative performance of US Treasuries against Singapore Government bonds. Figure 2 below shows the 10-Year Singapore Government bond yield falling faster than the US 10-Year Treasury yield.

Figure 2: Singapore Government Bond 10-Year Yield

Source: Bloomberg, 2 May 2025

IMPLICATIONS FOR SGD BONDS

Investors are increasingly looking at alternative bond markets as confidence in US Treasuries and USD assets declines. In this regard, several factors make the Singapore bond market looks attractive.

1. TOP CREDITWORTHINESS (AAA RATING)

The Singapore government has the highest possible credit rating (AAA) from all major international rating agencies. This signifies extremely low risk and high confidence that the government will meet its debt obligations, a reassurance in uncertain times. Singapore is one of the remaining few countries with AAA ratings from the three major rating agencies (the other countries being Sweden, Norway, Australia and Luxembourg).

2. GREATER ECONOMIC STABILITY

While Singapore's economy is expected to slow down due to the global trade impact (the government revised the 2025 growth forecast from 1-3% down to 0-2% the outlook is still relatively stable compared to the rising recession risks discussed for the US.

Singapore is widely recognised as a safe and reliable place for investment, especially when global conditions are uncertain.

3. LOW AND STABLE INFLATION OUTLOOK

Unlike the US, Singapore’s inflation is well contained. Price increases in Singapore have slowed considerably - core inflation (which excludes housing and car costs to give a better sense of daily expenses) averaged just 0.7% in January-February 2025, down from 1.9% in late 2024.

The Monetary Authority of Singapore (MAS) forecasts core inflation to be only 0.5% to 1.5% for the whole of 2025. This is significantly lower than the 2.8% or higher inflation projected for the US. Lower inflation means the interest earned on SGD bonds is likely to retain more of its purchasing power.

4. PROACTIVE AND CLEAR POLICY (MAS)

Singapore's central bank, MAS, manages the economy differently from the Fed. Instead of setting interest rates, it manages the Singapore dollar's exchange rate against a basket of other currencies (the S$NEER), aiming for slow, gradual appreciation to keep prices stable.

In response to the tariff risks and lower inflation, the MAS has already made proactive adjustments in January and April 2025, slightly slowing the pace of the Sing dollar's appreciation to support the economy. This demonstrates a clear and flexible approach, providing more predictability for investors compared to the current Fed uncertainty.

SGD INTEREST RATE TO REMAIN LOW DUE TO FLUSH LIQUIDITY

In light of the potential headwinds caused by the global slowdown in trade, we believe the MAS will ensure that there will be ample liquidity in the system. This would mean that SGD interest rates will be kept low, provided support for SGD bond prices.

In addition, the SGD NEER has been trading at the higher end of the band. To prevent the SGD currency from appreciating too strongly, the MAS would potentially have to intervene by selling SGD in the market. This would cause the SGD liquidity to be flush, giving another reason for the downward pressure on SGD interest rates.

THE BOTTOM LINE

The uncertainty created by the Trump administration provides a compelling proposition for investors to consider SGD bonds. They offer protection against Singapore's lower inflation, and benefit from clear, proactive policy management by MAS. We believe investors should consider adding funds with exposure to SGD bonds to provide resilience to their investment portfolio.