MACRO OUTLOOK

Global economic activity is expected to remain robust in 2026, supported by accommodative financial conditions, additional fiscal stimulus, strong artificial intelligence (AI) related capital expenditure, and an improved corporate earnings outlook.

Global inflation is projected to ease further in 2026 but remain above central bank targets in several advanced economies, notably the US and Japan. Over the longer term, AI-driven productivity gains should be disinflationary, but in the near term, higher defense outlays, AI-related upward pressure on power prices, and a policy focus on strategic autonomy over efficiency are likely to keep price pressures elevated.

With downside risks to growth receding, central banks are expected to refocus on upside risks to inflation. Outside the US, many central banks appear close to the end of their easing cycles, with the next policy move likely to be either an extended pause or a rate hike should inflation prove sticky. In contrast, a firmer US growth backdrop is not expected to prevent the Federal Reserve from continuing to ease policy, as the Fed remains focused on downside risks to the labor market.

United States

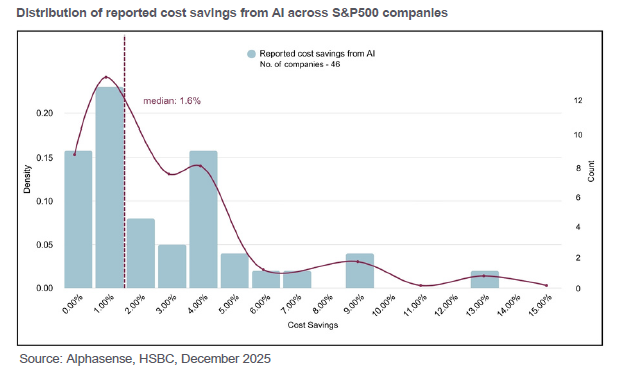

According to the International Monetary Fund projections, US GDP is likely to expand by about 2.1% in 2026, slightly above the estimated 2.0% in 2025. This growth is underpinned by an easier monetary stance, generous capex incentives, tax reductions, and deregulation. As policy uncertainty recedes and new trade agreements are concluded, the environment for private investment should improve, with AI-related spending acting as a key driver. AI capex could make a meaningful contribution productivity gains, potentially adding an estimated 40–50 basis points to growth. While the labor market remains characterized by a “slow to hire, slow to fire” mode, consumption is expected to recover gradually as headwinds from trade frictions and immigration constraints fade and fiscal support becomes more visible.

Eurozone

The Eurozone’s growth outlook is expected to improve in 2026 as earlier headwinds from tariffs and French political uncertainty are largely behind. Several potential catalysts could support activity, including a ramp-up in German fiscal stimulus, a higher probability of a Russia–Ukraine ceasefire, and a positive turn in the Eurozone credit impulse. Germany’s economy is expected to gain momentum, with higher infrastructure and defense spending lifting GDP growth to about 0.8% in 2026 from roughly 0.3% in 2025, although export growth is likely to remain subdued following the impact of US tariffs.

China

China’s GDP growth is projected to slow modestly to around 4.5% in 2026, with exports likely to decelerate and net exports making a smaller contribution to overall growth. Domestic demand should remain relatively resilient, with consumption growing at a moderate but softer pace, and infrastructure and manufacturing investment stabilizing after a sharp year-on-year contraction in the second half of 2025. The 15th Five-Year Plan prioritizes boosting consumption, although initial implementation is expected to be measured. Beijing is expected to maintain a policy “floor” under growth but is unlikely to launch large-scale, broad-based stimulus. The property downturn is likely to persist but with smaller contractions as the rapid expansion of “new economy” sectors continues to offset part of the drag from real estate. China, still has room to ease policy further via benchmark lending rates and reserve requirement cuts if needed to secure its 4.5–5% growth objective.

Japan

The Bank of Japan (BoJ) raised rates in December, with core inflation at roughly 2.8%, above its 2% target, and yen weakness supporting the case for earlier normalization. The BoJ remains behind the curve, and markets are pricing in additional rate hikes by end-2026, with Governor Ueda signaling a neutral rate range of roughly 1-2.5%, implying a gradual and extended normalization.

EQUITIES

United States

US equities should remain supported by resilient consumer demand and strong AI-related spending despite a softer labor market and lingering trade headwinds. Visibility on the AI investment cycle has improved, and there is broad consensus that spending commitments from both corporates and governments are largely locked in for the next two years. While valuations appear elevated, multiples are discounting above-trend earnings growth, a sustained AI capex boom, rising shareholder payouts, and looser fiscal and monetary settings. Corporate earnings may also benefit from deregulation and the gradual broadening of AI-driven productivity gains across sectors. Monetization of AI is expected to remain a central focus as firms leverage AI both to create new revenue streams and to generate cost efficiencies. Aggregate US earnings growth is projected to accelerate to around 13–15% per annum over the next two years, versus a long-term average earnings-per-share (EPS) growth of roughly 8–9%.

Eurozone

Corporate earnings are expected to reaccelerate in 2026, with earnings growth projected at above 13%, supported by stronger operating leverage, reduced foreign-exchange and tariff headwinds, easier prior-year comparisons, and improving financing conditions. In Japan, equities should be underpinned by robust earnings, ongoing corporate governance reforms, the Tokyo Stock Exchange’s push for higher return on equity (ROE), rising share buybacks, improving wage dynamics and a supportive domestic policy framework.

Asia

Asian equities are likely to be supported by lower domestic interest rates, stronger earnings growth, attractive relative valuations, continued improvement in corporate governance, healthier fiscal balance sheets and resilient global demand. In China, the liquidity-driven equity rally may continue, underpinned by optimism around AI innovation, selective policy support and expectations of targeted stimulus measures, even as authorities refrain from aggressive demand-side stimulus. South Korea remains a key beneficiary of AI-related tech demand and stands to gain from the Value Up Programme, as well as a favorable cycle in defense and shipbuilding exports. Taiwan is another primary winner from AI adoption, anchored by TSMC’s leadership in advanced process nodes, with supply-side tightness supporting pricing power and margins despite headwinds from a stronger Taiwan dollar.

Singapore

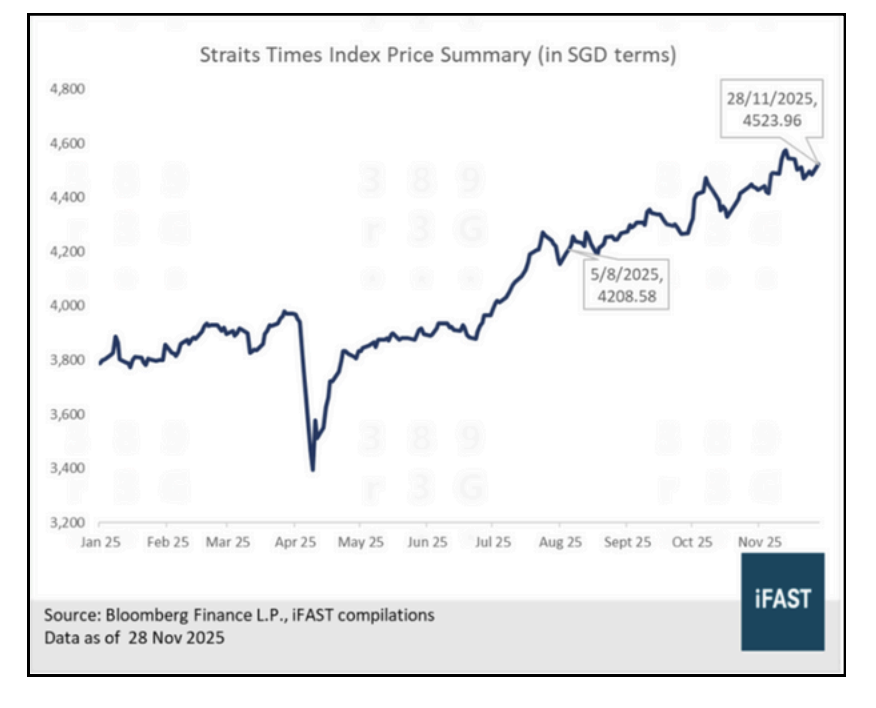

Singapore is increasingly following the path of Japan and South Korea with its own “Value Up” style initiatives. These reforms, combined with prudent fiscal management, have attracted strong foreign inflows. The Straits Times Index (STI) delivered a strong rally in 2025, outperforming 2024 despite significant volatility linked to geopolitical tensions and uncertainty around Fed policy. Robust export growth, solid domestic macro data, and an upward revision of Singapore’s GDP growth to around 4%, alongside Singapore’s safe-haven status and a strong Singapore dollar, helped broaden market participation. Stock market development measures announced by the Monetary Authority of Singapore (MAS), including the S$5 billion Equities Market Development Programme (EQDP), the dual-listing bridge between SGX and Nasdaq, the launch of the iEdge Singapore Next 50 indices and the S$30 million Value Unlock Programme aimed at enhancing corporates’ strategic and investor-relations capabilities, are supporting elevated investor interest.

We are positive on Singapore equities. The medium-term Singapore equity story remains underpinned by structural drivers such as safe-haven fund flows, a positive industrial cycle, rising dividends per share and liquidity tailwinds from ongoing market reforms. The capacity of Singapore-listed corporates to raise dividends above pre-pandemic levels positions the local market defensively amid global uncertainty. Market performance can further be supported by improving system-wide liquidity, deeper integration of technology into industrial applications and sustained relative outperformance as a regional safe haven. Valuation re-rating is likely to be maintained as earnings growth continues and management teams focus on shareholder value creation.

FIXED INCOME

The Federal Reserve delivered a third consecutive 25 basis point cut in December 2025, bringing the policy rate to the 3.5–3.75% range. Chair Powell indicated that with rates now close to neutral, the phase of “risk management” cuts is largely complete and that further easing will depend on a material deterioration in labor market conditions. A further 25 basis points cut in January remains possible if upcoming labor data deteriorate meaningfully.

At the front end of the US Treasury curve, yields are likely to be anchored by renewed balance sheet expansion from the Fed and higher Treasury bill issuance, partly driven by structural demand from stablecoins. However, the rapid increase in US public debt suggests investors will continue to demand a higher term premium for longer-duration Treasuries, driving a gradual steepening of the yield curve.

For Asia USD credit, an easier US rates environment provides a constructive backdrop, but investors are expected to remain highly selective. Persistent geopolitical flashpoints and uneven macro data across Asia are likely to keep volatility elevated into early 2026. Recent US economic indicators have been broadly balanced, supporting a base-case scenario in which credit spreads trade in a range in the near term. All-in yield buyers, including cross-border real-money investors and insurance companies, are expected to remain the dominant source of demand for Asian credit.

KEY RISKS AND OPPORTUNITIES

While the overall outlook is constructive, several risks remain. A key risk is a reversal in the AI thematic trade amid concerns about overcapacity and excess capex. Renewed geopolitical tensions, or unexpected inflation could challenge the positive scenario. On the other hand, continued AI-driven productivity gains, successful market reforms, and resilient demand in Asia present significant opportunities for investors in 2026.

All data are sourced from Lion Global Investors and Bloomberg as at 23 December 2025 unless otherwise stated.