Macro Movers & Shakers

| Growth | Inflation | Policy | |

|---|---|---|---|

| US | Investor sentiment remained resilient thanks to employment. However, continuous claims are rising indicating that replacement jobs are hard to find. There are initial signs of consumer sentiment and business conditions weakening while inflation stayed sticky despite tariff increases. S&P 500 2Q earnings exceeded expectations, helped by lowered forecasts. | U.S. headline inflation rose to 2.7% year-over-year, while core inflation increased 2.9%. While Producer Price Index (PPI) rose by 2.3%, indicating moderate upstream cost growth. Overall, inflation remains above the Federal Reserve’s 2% target, keeping rate cut expectations in check. Inflation should rise as higher tariffs feed through, in the coming months. | Market expects 2 rates cuts by year end with high chance of another cut in September. There will be a replacement after the resignation of Fed Board member Krugler. While tariffs may push prices up temporarily, the Fed also has the duo mandate to ensure full employment which could be more supportive for an imminent rate cut. |

| Europe | Europe's economic momentum lagged behind the U.S., but investor optimism remained due to hopes for stimulus measures and a quick resolution to the US-EU tariff dispute. Notably, economic sentiment improved for the third straight month in July, reaching its highest level since February 2022. | Eurozone inflation remains stable, with headline at 2.0% and core at 2.3%. While producer prices are subdued and investment is solid, weak consumption and rising Asian import competition continue to dampen growth momentum. | The tariff-related slump, combined with ongoing disinflation, may open the door to one last European Central Bank (ECB) cut of 0.25% this year. Bank of England is also uncertain when officials will cut rates next, choosing to first see the tariffs impact on the economy. |

| Asia | China's economy grew 5.2% year-on-year in Q2 2025, slightly below the previous quarter but better than expected. However, deflation risks, weak domestic demand, and the potential renewal of U.S. trade tensions after a temporary deal expires in mid-August could weigh on growth in the second half of the year. | Inflation remained modest and below most central bank targets. In China, core inflation rose to 0.7%, its highest in over a year, signaling mild recovery in domestic demand. However, producer prices fell 3.6%, reflecting persistent deflationary pressure from industrial overcapacity. | China still have some policy room to ease borrowing costs and reserve requirements for banks if needed to ensure it meet the 5% growth target. Reserve Bank of Australia (RBA) is expected to cut 0.25% to key rates in August 2025 to support the economy. MAS kept SGD policy steady in July, and next meets in October. |

| Japan | Japan’s economy is recovering moderately, supported by wage growth and resilient consumption. Higher interest rate costs in the form of bond yields are impacting corporate earnings. External risks and weak global demand continue to pose challenges to sustained growth. | Inflation held steady at 3.3%, >2% target for more than 3 years. Rising food prices—especially rice—were offset by falling energy costs and subdued producer prices, helping to limit broader inflation pressures. The Bank of Japan expects inflation to moderate slightly but remain above its 2% target. | Monetary policy normalization in Japan is expected to be maintained, driven by higher wages demand. However, potential changes in the Cabinet, and the growing concern that JPY appreciation could dampen momentum for rate hikes. |

| RISKS |

|---|

| - Trade tensions escalate as US/China fail to reach an agreement - Sticky inflation means that the Fed must keep rates higher for longer - Policymakers in China fail to stabilize growth |

Sensible Considerations

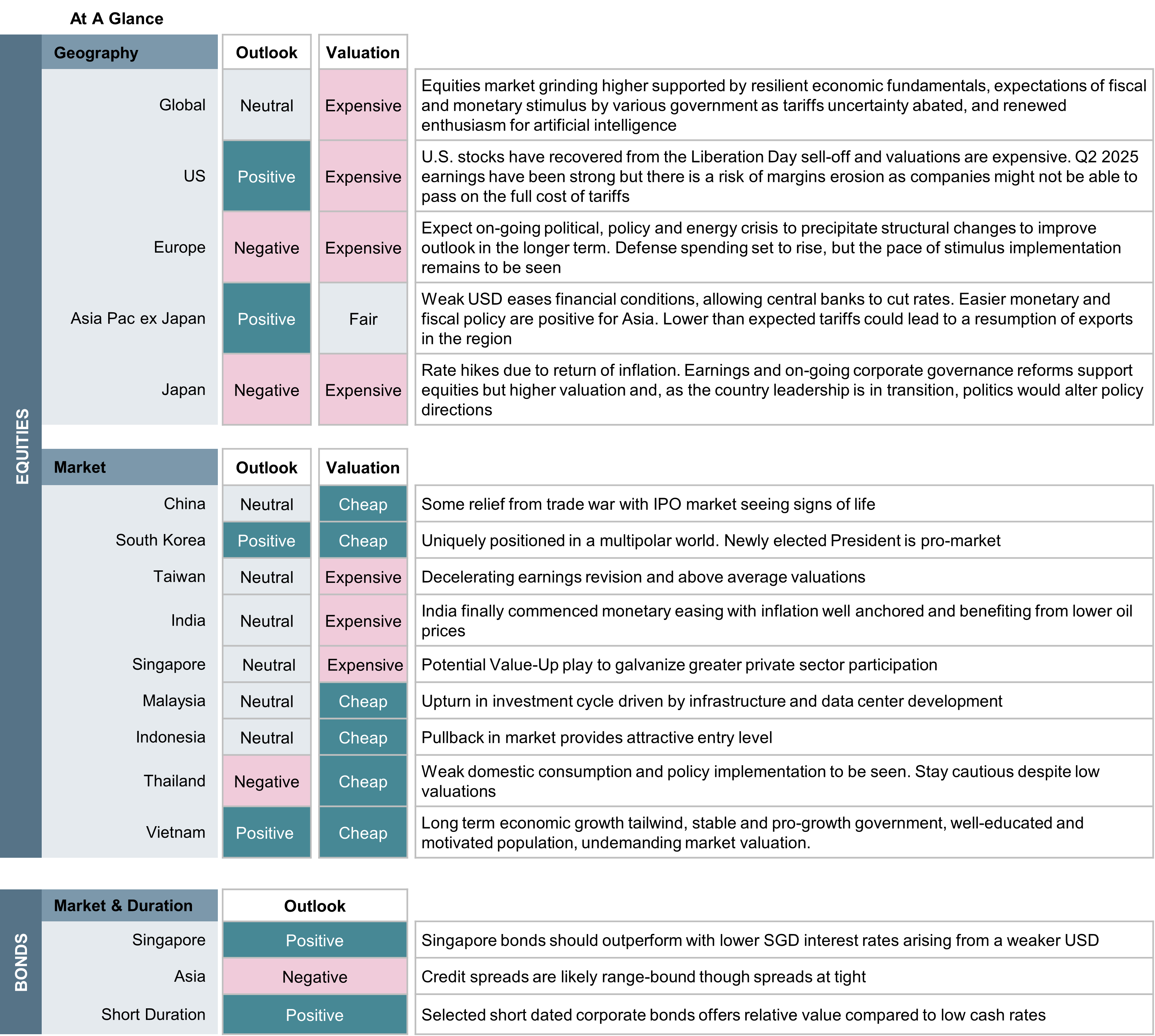

At a Glance | General Product Suite

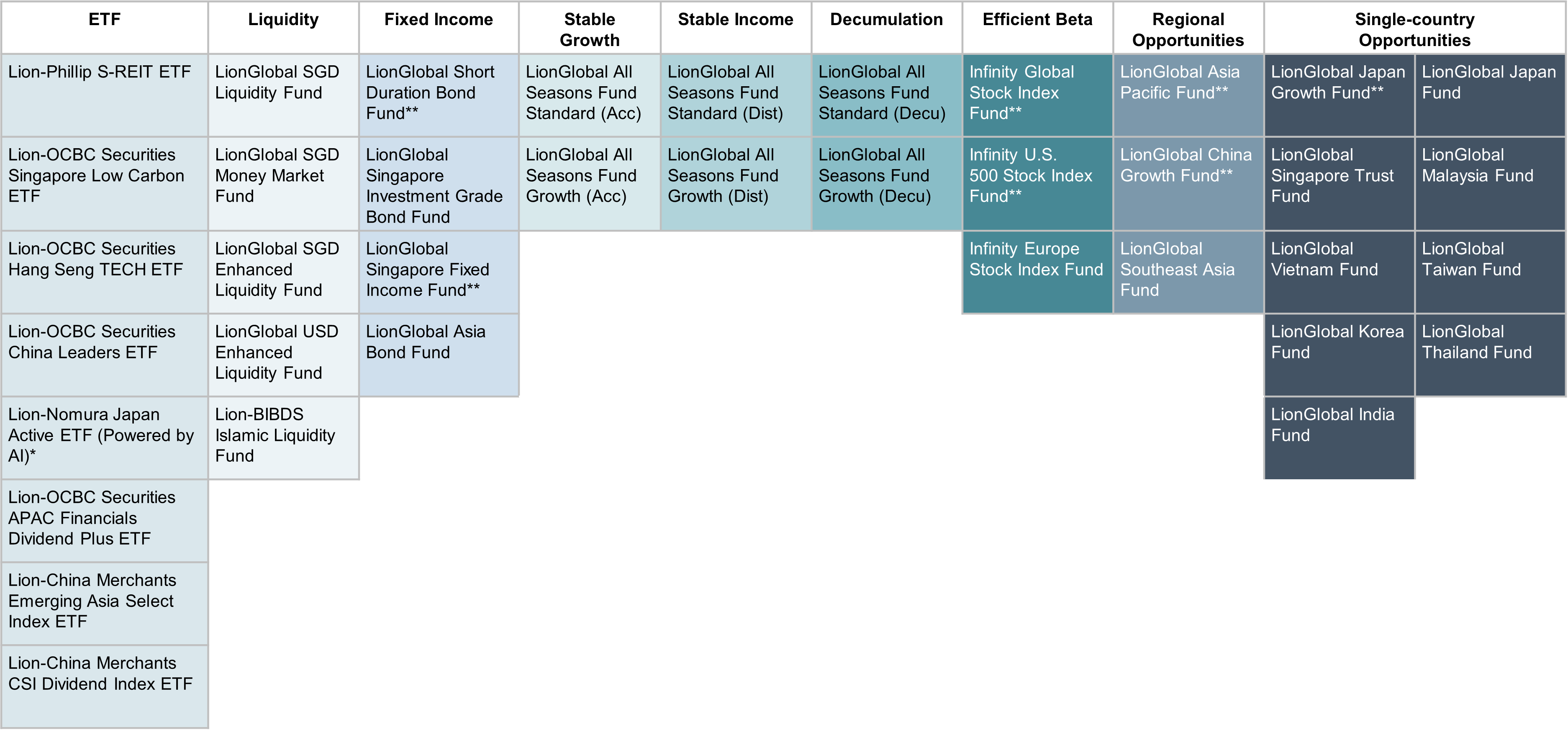

**CPFIS Funds: LionGlobal Short Duration Bond Fund Class A SGD (Dist), LionGlobal Singapore Fixed Income Investment Class A SGD, Infinity Global Stock Index Fund SGD, Infinity Global Stock Index Fund Class C SGD, Infinity U.S. 500 Stock Index Fund SGD, LionGlobal Asia Pacific Fund SGD, LionGlobal Japan Growth Fund SGD, LionGlobal Japan Growth Fund SGD-Hedged and LionGlobal China Growth Fund SGD.

All data are sourced from Lion Global Investors as of 31 July 2025, unless otherwise stated.