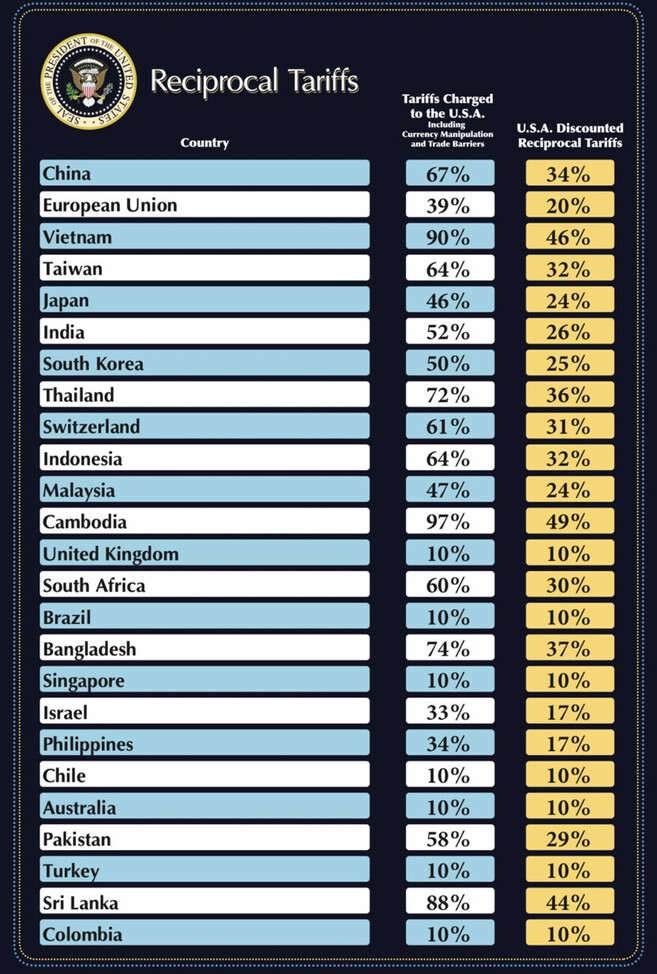

President Trump’s “Liberation Day” Tariffs had sent shockwaves through the markets, plunging into trade wars and increasing a recession risk. President Trump is imposing a minimum 10% tariff on all exporters to the United States and additional reciprocal duties on approximately 60 nations with the largest trade imbalances with the United States. In this article, we will focus on how the tariffs may affect the markets.

Figure 1: “Liberation Day” Tariffs as announced on 2nd April 2025

Source: Truth Social/Donald J. Trump, 2nd April 2025

EQUITY

Donald Trump’s “Liberation Day” tariffs, announced on April 2, 2025, have introduced significant uncertainty affecting Asian markets. These sweeping tariffs include a baseline 10% levy on all US imports, with higher rates targeting countries with substantial trade surpluses with the US, many of which are in Asia. The immediate reaction in Asian financial markets has been marked by volatility and declines, reflecting concerns over disrupted trade flows, higher costs, and potential retaliation.

China, already under a 20% tariff from prior measures, now faces an additional 34% levy, bringing its total to 54%. While its stock market response was more contained due to its domestic revenue base, the tariffs threaten its export competitiveness. While there may be concerns of countermeasures, China’s likely response is to make some modest retaliatory moves, increase support for domestic demand, and focus on improving its industrial competitiveness. There is limited evidence that China has been engaging in meaningful negotiations with Trump. China’s intentions could well be to boost its long-run economic strength while the US is busy undermining itself through tariff hikes that will lead to stagflation if not outright recession.

India faces a 26% tariff, which is notably lower than rates imposed on some other Asian exporters. India’s economic structure is also relatively insulated compared to export-heavy Asian peers. The Indian government is responding strategically to mitigate the tariffs’ impact, signaling a dual approach of diplomacy and domestic reform. The upcoming 2025 budget is expected to prioritise deregulation — easing bureaucratic hurdles for businesses — and tax cuts to boost consumption, which grew at 6% in 2024 but needs a push to offset export losses. Finance Minister Nirmala Sitharaman has hinted at measures to “unleash animal spirits,” potentially including reduced personal income taxes and simplified GST (Goods and Services Tax) slabs.

South Korea's economy is heavily reliant on exports, particularly in sectors like electronics and automotive, which are likely to be affected by the 25% tariffs. South Korea is the second-largest vehicle exporter to the U.S and investors fear reduced US demand or squeezed margins if costs aren’t fully passed to consumers. Hyundai’s* $20 billion US investment plan, meant to secure favour, failed to shield it from selling pressure. Samsung Electronics* and SK Hynix* dominate South Korea’s tech exports, with the US a key market for consumer electronics and chips. Semiconductors are currently exempt from the reciprocal tariffs, but uncertainty looms. Acting President Han Duck-soo’s emergency subsidies and diplomatic push could secure exemptions, leveraging South Korea’s security role and US investments. A deal might lift the stock market.

Taiwan's heavy reliance on exports, especially to the US, is impacted by the 32% tariff. While semiconductors are currently exempt from the reciprocal tariffs, Trump has previously signaled potential future levies on this sector. TSMC’s (Taiwan Semiconductor Manufacturing Company Limited)* $65 billion investment in Arizona fabs aims to mitigate some of the risks by producing locally. Taiwan’s non-chip electronics sector (e.g. assembly, machinery, optoelectronics) faces the full 32% reciprocal tariff, raising costs for US importers of products like laptops and consumer electronics.

Southeast Asian countries, many of which have leveraged US market access for economic growth, face even steeper tariffs. Thailand, with a 37% tariff, and Indonesia, with a 32% tariff, also saw market declines, with Thailand’s government expressing confidence in a “strong plan” to negotiate reductions, though immediate impacts on electronics and agricultural exports are anticipated. Vietnam, hit with a 46% tariff, saw its main stock index plummet 6.8% on April 3, 2025, as the US accounts for 29% of its total exports, equivalent to 30% of its GDP. Singapore, subject only to the 10% baseline tariff, may see relative stability or even benefits as a supply chain hub, given its lower exposure to punitive rates.

The broader impact on Asian markets hinges on several factors: the duration of the tariffs, the extent of retaliatory actions, and the ability of exporters to pivot to alternative markets or absorb costs. For now, the initial market sell-offs underscore a region grappling with uncertainty, as Trump’s policies challenge decades of trade liberalisation that have fueled Asia’s economic rise. Offsetting some of these pressures are a weakening US dollar and potential interest rate cuts as Asian governments are in a better position to ease monetary policies in an attempt to boost their domestic economies.

FIXED INCOME

President Trump announced tariffs (Universal 10% effective on 5th April 2025, and Reciprocal effective on 9th April 2025) on 2nd April 2025 which turned out to be more severe than what markets were anticipating, triggering a sharp sell-off in risk assets and driving US Treasury bond yields lower. While universal tariffs are unlikely to be negotiated away as Trump intends the tariffs to be an external revenue source, there is probably room for negotiations for reciprocal tariffs since the deadline is about a week away. What remains to be seen is the retaliation from some countries, which could trigger further weak sentiments.

The tariff announcement triggered risk-off moves in equities while US 5-year and 10-year Treasury yields dropped by 12- 15 basis points. USD Investment Grade corporate bond spreads were wider 5-10 basis points, thus negating the drop in US Treasury yields. This resulted in USD corporate bond yields being largely unchanged.

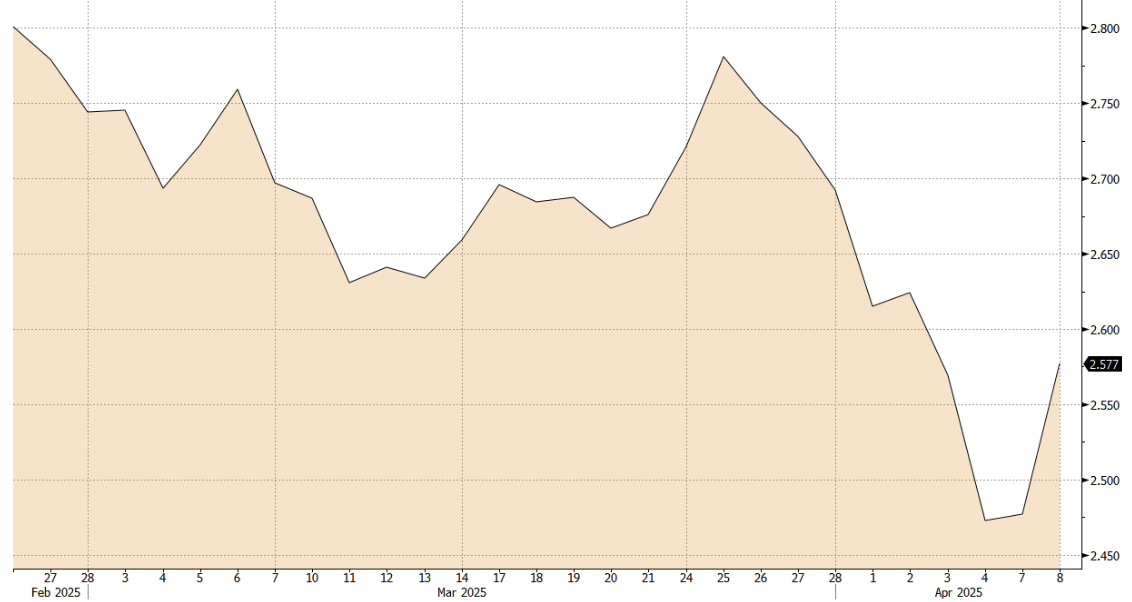

Singapore Government 5 to 10-year bond yields were lower by 5-6 basis points with reaction in SGD corporate bonds largely muted as SGD investors are still looking to buy SGD corporate bonds in this lower yielding environment. We believe that SGD rates will outperform USD rates in this environment as USD rates remain sensitive to inflation caused by the tariffs.

Figure 2: Singapore Government Bond 10-Year Yield

Source: Bloomberg, 8th April 2025

The new tariff development reinforces the view for credit spreads to widen out modestly but remain supported by credit fundamentals. In terms of credit, we continue to believe Asian Investment Grade (IG) credits can be more resilient than US IG credits due to better technical support. This mitigates the risk for the USD credits holdings in our portfolios as the credits are mainly from Asian issuers. The USD credits that are held in our portfolios are very short-dated, which should not see large adverse price movements.

We are closely monitoring further developments in this area and are also watching out for any adverse impacts on the credits that we hold. As most of our portfolios are investment in high quality investment grade credits, we do not think that the credits we hold will have any adverse impact on their credit profile.

MULTI-ASSETS

The magnitude and disruptive impact of Trump’s trade tariffs if sustained, has increased the probability of a US recession. The tariff shock will likely be magnified by its effect on sentiment and through potential disruptions to global supply chains. A stagflation environment has also become a distinct possibility with a combination of a slowdown in economic activities and an increase in prices. A global recession cannot be ruled out although countries that are targeted by the retaliatory tariffs are likely to announce a slew of fiscal measures and boosting domestic consumption to mitigate the impact of an economic slowdown. For example, China, which has already announced a package of easing measures and boosting consumption is likely to frontload those measures.

We can expect market volatility to persist as the US Administration has expressed a willingness to tolerate more pain in short term. The possibility of de-escalation could only happen if affected countries offer a good deal that could reduce the bilateral trade deficits in return for reduced tariffs. But substantial uncertainty remains, especially as retaliation from other countries are announced. The market has started to price up to 4 rate cuts this year, and we have seen a decline in long dated yield as well. The upward pressure on inflation from tariffs hike has made the Fed’s job more complicated.

However, the Fed is likely to prioritise growth in the face of a sharp economic slowdown and cut rates while defending the inflation rise as transitory.

In view of the increase in market volatility, we have reduced some of the equities exposure. In the current uncertain market environment, we would maintain a lower exposure to equites. The fixed income portion and the gold holding have helped to mitigate the losses from the equity allocation. For the fixed income exposure, we are also watching out for any adverse impacts on the credits we hold.

All data are sourced from Lion Global Investors and Bloomberg as at 8 April 2025 unless otherwise stated. *Securities referenced are not intended as recommendations to buy or sell securities. Opinions and estimates constitute our judgment and along with other portfolio data, are subject to change without notice.