ESG is dead.

You will not be wrong to think so, if we look at the recent performance of solar and electric vehicle (EV) stocks. These sectors are often synonymous with ESG. ESG funds were heavily weighted in these sectors. When these sectors went down, interest in ESG investing went with it.

A key reason for the underperformance was that investors and businesses alike, misunderstood the true nature of these sectors. Many investors and businesses believed the growth of these sectors was structural, due in part to ESG. Yet, these industries are inherently cyclical. Take EVs, for instance— aren’t EVs just autos, which is a notoriously cyclical sector?

While the long-term trend for these sectors may be structurally positive, the journey is paved with potential for huge cyclical swings. Businesses that extrapolated linear growth – over-invested – and now grapple with overcapacity issues, a stark reality in the solar industry. Over-investment is a feature, not a bug, of cycles. And in this case, fortunes were made and lost on it.

Does it always end in tears? Let’s consider other possibilities.

What if there are sectors which are cyclical but are in fact enjoying durable demand growth due to ESG, because investors and businesses alike did not extrapolate and over-invest? Where the lack of exuberance has in fact led to a real change in cyclicality for the sector?Shipbuilding—a sector known for its cyclicality

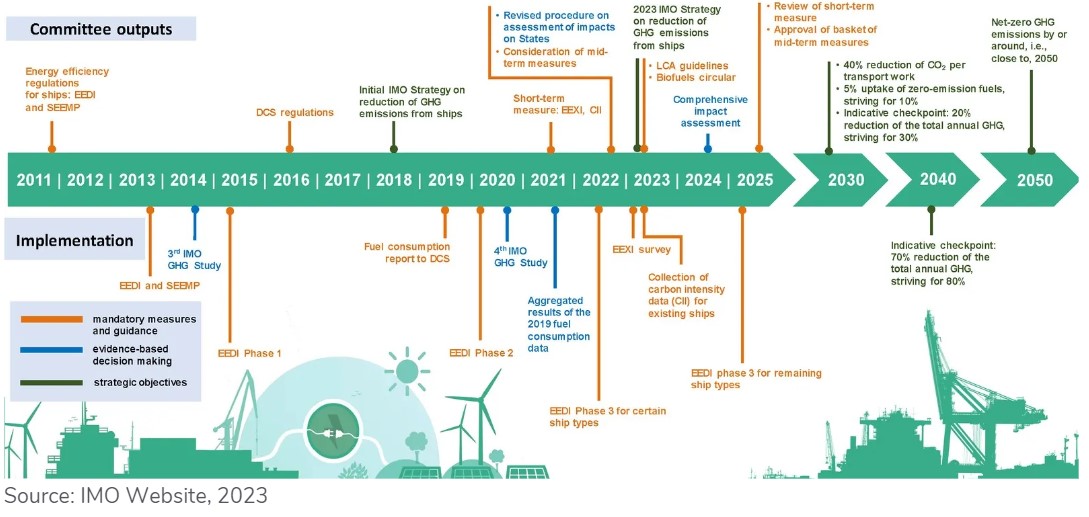

Enter shipbuilding—a sector known for its cyclicality.Today, we see an interesting story unfolding in shipbuilding. Demand for new vessels is extremely steady and robust, as liners look to replace older vessels with newer more efficient vessels. This is driven by tighter environmental regulations from the International Maritime Organization (IMO). In addition, starting in 2024, the EU requires liners to purchase carbon credits to cover their emissions while in EU waters. This provides additional incentives for liners to place orders for newer, more efficient vessels. Separately, emerging products like low carbon clean ammonia, due to ESG considerations, are boosting demand for new specialized vessel types.

Figure 1: 2023 IMO Strategy on Reduction of Greenhouse Gase (GHG) Emissions from Ships

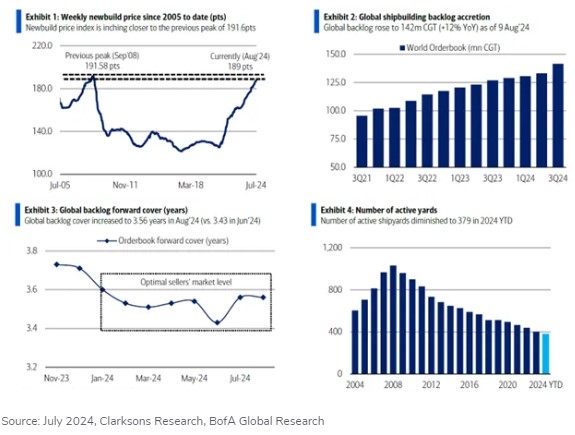

Shipbuilding orders have come in steadily, leading to a build in order backlog for most shipbuilders. Yet, shipbuilders are not expanding capacity aggressively. Shipbuilders are experiencing PTSD, having just survived through a nasty downcycle. As a result, unlike their counterparts in solar and EVs, shipbuilders have been cautious about expanding capacity despite a growing order book.

Figure 2: Shipbuilding Industry Statistics

ESG is Real.

Their order book trends illustrate a crucial point— ESG is real. ESG considerations are driving real-world demand in the shipbuilding industry. With controlled capacity growth, shipbuilders are poised for a more stable earnings profile, backed by a strong order backlog that provides multi-year visibility.

Has ESG transformed cyclicality for shipbuilders? Are investors committing the same judgement mistake here as they did for EVs, except that they are over-emphasizing the cyclicality here rather than under-stating it? Would investors reward these companies with higher valuations as the earning profile of such companies becomes less volatile, more predictable over the next few years?

Year-to-Date performance of shipbuilders seems to suggest so.

We are not suggesting that ESG is the only factor at play here. But clearly, it is of meaningful relevance here.

On a final note, ESG investing is no longer in the easy mode of the early 2020s, where you just pile into EV and solar. But opportunities are still plenty when we connect the dots the right way.

ESG is well and alive. Have fun investing.

All data are sourced from Lion Global Investors and Bloomberg as at 28 August 2024 unless otherwise stated.