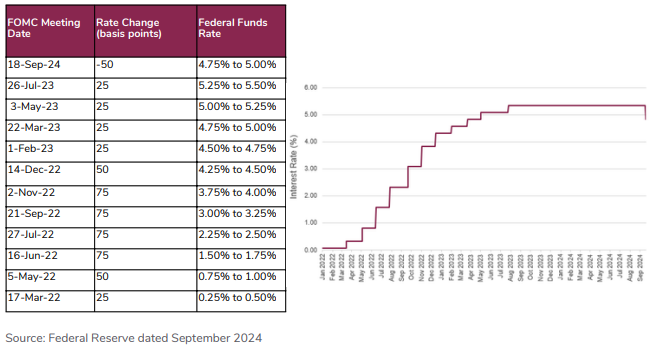

Figure 1: Federal Reserve interest rate hikes to rate cuts ahead (2022-2024)

Market Outlook and Strategy

2. The US economy appears headed for a soft landing. The labor market has lost momentum, but consumer spending remains healthy, supported by steady income gains. The manufacturing sector (except for computers and electronics) continues to stagnate, with companies reducing production as new orders slow.

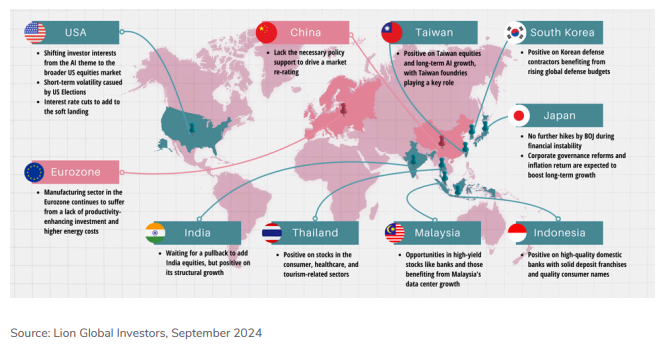

3. The Eurozone's economic recovery has been slow. The unemployment rate, though still high, declined gradually in recent months, supported by a resilient service sector offsetting weaknesses in manufacturing. The manufacturing sector in the Eurozone continues to suffer from a lack of productivity-enhancing investment, higher energy costs, and intensifying China's competition for export markets.

4. In China, industrial production slowed further, as reflected in the official manufacturing purchasing manufacturers index (PMI) in August. The official non-manufacturing PMI also remained soft even after accounting for summer holiday spending. Deflationary pressure is building in China, with excess capacity building. So far, policy measures to rescue the property market and support consumption have had a relatively muted impact. China would require more proactive fiscal measures and more dovish monetary policies to support growth and address the deflationary pressure.

5. With inflation on a sustainable path to target and as downside growth risk edges up, the Federal Reserve started with 50 basis points cut in September and with the dot plot projecting further easing ahead. The European Central Bank (ECB) cut its deposit rate by 25 basis points as expected and narrowed the corridor in line with the recent changes to its operational framework. The ECB remains on a path of gradual rate normalization, guiding toward quarterly 25 basis points cuts.

6. The Bank of Japan kept its policy settings unchanged in September instead of continuing its interest rate hiking cycle, citing upside risks to inflation from a weaker yen and rising import prices have diminished and that there is time to consider making further changes.

Equity

8. We are positive on North Asian equities except for China equities, which lack the necessary policy support to drive a market re-rating.

9. We are positive on South Korea equities as the Value Up Program continues to drive greater value for shareholders, and we are positive on Korean defense contractor names that benefit from increasing defense budgets globally. We are positive about Taiwan equities and the long-term growth potential from artificial intelligence investments, especially with Taiwan foundries being a critical component in this story. We would wait for better opportunities during a pull-back to add to India equities due to rich valuations though we remain positive on India’s structural story.

10. We are positive on Japan equities despite heightened volatility in recent months after the Bank of Japan (BoJ) surprised the market with a policy rate hike on 31st July, indicating the start of a rate hike cycle. The Japanese Yen strengthened sharply against the US Dollar, and the unwinding of the Yen-carry trade led to a sudden spike in market volatility. The BoJ has since calmed the Japanese market by clarifying that they would not rate hikes during financial market instability. Despite the prevailing cautious sentiment, we believe continuing corporate governance reforms and the return of inflation in Japan will have a more significant positive impact on the market.

11. We are also positive on ASEAN equities as they benefit from the US interest rate cuts. These economies are also more domestic-oriented, which would act to diversify against North Asia’s export-oriented economies. In Malaysia, we see opportunities in high-yield stocks, such as banks, and stocks that benefit from the development of the data center industry in Malaysia. In Indonesia, we are positive on high-quality domestic oriented banks with solid deposit franchises and quality consumer names. In Thailand, we are positive on stocks in the consumer, healthcare, and tourism-related sectors.

Figure 2: Many markets in Asia have their own unique positive drivers

Fixed Income

*All data are sourced from Lion Global Investors and Bloomberg as at 20 September 2024 unless otherwise stated.