2026 SINGAPORE OUTLOOK

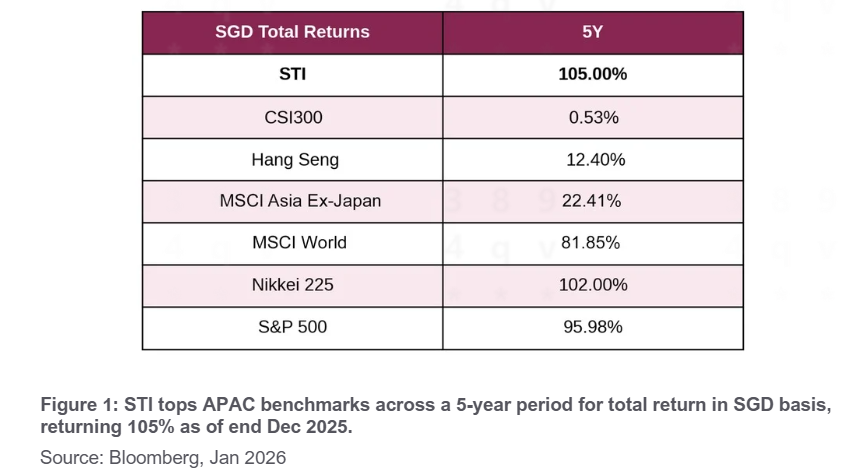

The Singapore Equity Market has been a strong performer. Over the past five years, the STI Index has outperformed most major indices on a total return basis, highlighting both its marked change in performance over the prior 5-year (5Y) period as well as the importance of both a strong currency and dividends that the Singapore Equity Market offers towards total performance returns.

Recently, efforts by the Monetary Authority of Singapore (MAS) to revive the Singapore Equity Market through the S$5 billion Equity Market Development Programme (EQDP) have brought attention and activity to Singapore equities. So far, a total of S$3.95 billion has been announced by MAS as of 19 November 2025. This begs the question: how sustainable is the strong performance of the Singapore market beyond the EQDP stimulus?

Sustainability of the Singapore Equity Market

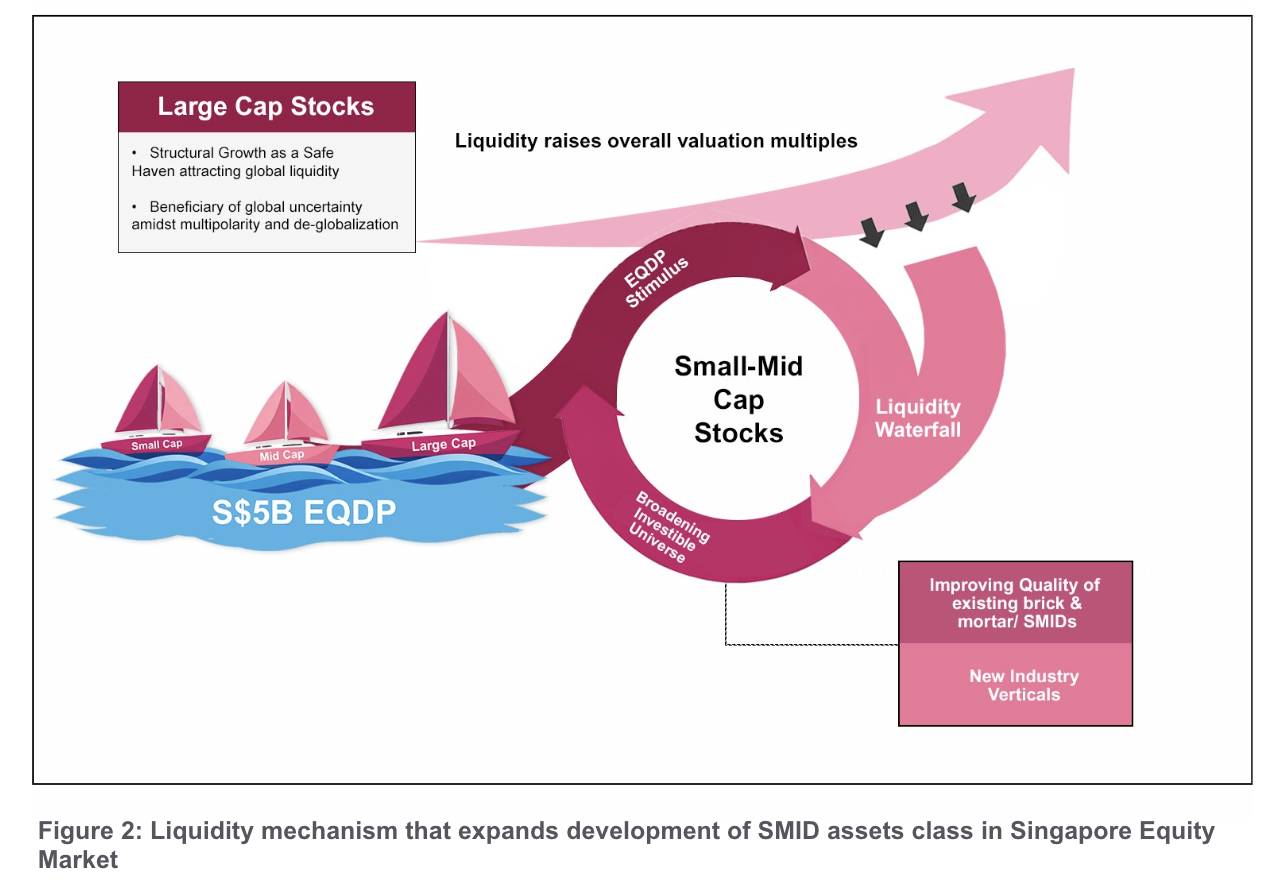

To answer this, a broader perspective of the mechanics of the Singapore Equity Market is required. The Figure 2 below outlines a framework explaining the liquidity mechanism that can fuel the development of the Small-Mid Cap (SMID) asset class in the Singapore Equity Market:

(i) Large Cap outperformance attracts liquidity from global investors. In any stock exchange across the world, liquidity in the Small-Mid cap asset class is primarily driven by domestic investors (whether retail or institutional);

(ii) Profit taking by domestic investors redeploys into SMID asset class, fueling liquidity into the sector. SMIDs ride a liquidity tailwind when Large Cap stocks perform well, as domestic investors take profit from large caps and reallocate into SMIDs, creating a liquidity waterfall;

(iii) Additional liquidity from the MAS EQDP programme can support valuation re-rating of the SMID asset class;

(iv) Improved valuations provide the conditions to attract more growth-oriented companies to list on the Singapore exchange and attract more capital such as via Initial Public Offerings (IPOs), dual-listings and follow-on placements.

Likewise, the strong performance of the STI Index attracts global investors to large cap stocks, with the combined market capitalisation of the STI Index increasing from S$870 billion in end 2024 to S$1.1 trillion at end 2025. This increase of more than S$200 billion in market capitalisation materially outweighs the MAS S$5 billion EQDP programme. Therefore, the sustainability of the SMID re-rating depends largely on whether the STI Index can continue it’s strong performance, providing a source of macro-liquidity for the SMID asset class in Singapore.

Sustainable Growth as a Global Safe Haven Platform

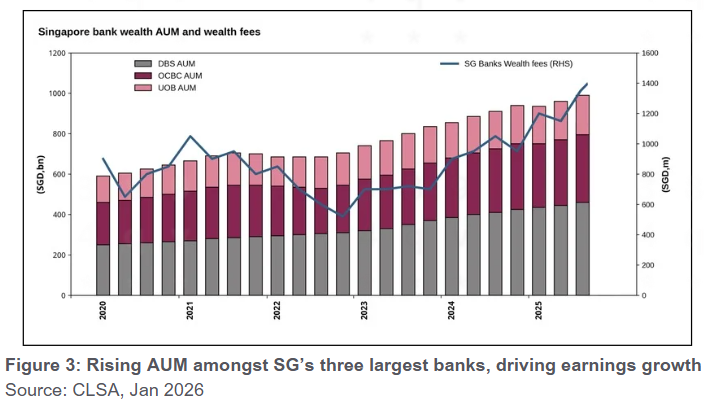

One key driver for the strong performance of the STI Index has been the performance of the Financials sector. The Figure 3 below illustrates how Singapore’s growing status as a global safe haven continues to attract growth in Assets under Management (AUM) amongst the three largest local banks, thereby contributing to earnings growth. Looking ahead, with global geopolitical uncertainty continuing to make headlines, Singapore’s strength as a safe haven is likely to be a continued tailwind for growth in valuations of the broader STI Index. A strongly performing STI Index would be a key source of liquidity that can support the continued development of the SMID Index in Singapore.

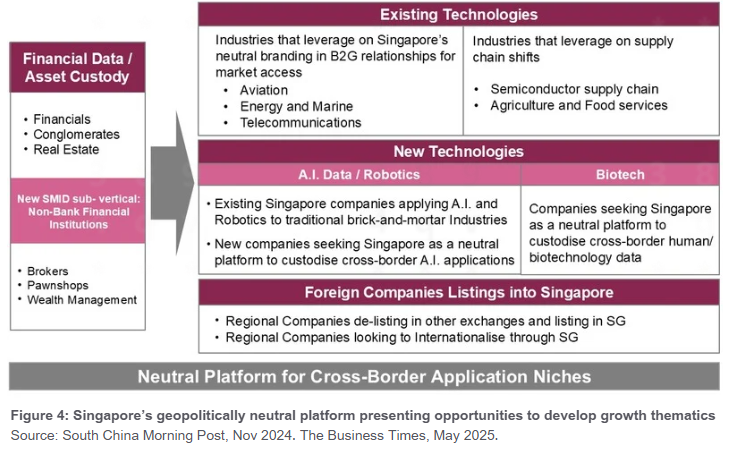

Broadening the Investible Universe – Developing a Neutral Platform

With the performance of the Financials sector in the STI Index as proof of Singapore’s strengthening safe haven status, the Singapore Equity Market can leverage this status to develop growth thematics based on Singapore’s core competency as a geopolitically neutral platform for cross-border export applications. Existing export-related sectors in the STI, such as those in the Aviation, Energy & Marine and Telecommunications spaces, rely on this aspect of the Singapore brand for Business-to-Government (B2G) engagements to gain market access.

New technologies such as artificial intelligence and biotechnology are examples of geopolitical-contested sensitive technologies where Singapore can offer a platform for cross-region exports, particularly in navigating the multipolar world of the future. We anticipate companies across the Asia region to leverage this platform to establish their international headquarters in Singapore and list on the Singapore Exchange. This mechanism can accelerate the set of growth thematics that the Singapore Equity Market can offer.

CONCLUSION

Whilst investor interest has been focused on how the MAS EQDP programme can sustain a revival in the Singapore Equity Market, it is also important to consider that the overall STI Index is already riding on the tailwinds of Singapore being a beneficiary of global geopolitical uncertainty, which may last for many years beyond 2026. The opportunity for investors is to recognize that the liquidity, from the thematic of global funds seeking safe haven, has the ability to drive the re-rating of the Singapore Equity Market. This can further attract more growth companies to populate the growing number of stocks listed on the Singapore Exchange, thereby creating a virtuous re-rating cycle and growth narrative for the overall Singapore Equity Story.

All data are sourced from Lion Global Investors and Bloomberg as at 3 February 2026 unless otherwise stated.