Outlook on FED and US Interest Rates

Financial markets started 2026 with a constructive outlook. The Federal Open Market Committee (FOMC) kept the target range for the Federal Reserve's (FED) funds rate unchanged at 3.50-3.75% at the January 2026 meeting. The statement cited that economic activity had been expanding at a solid pace, unemployment rate had shown some signs of stabilization while inflation remained somewhat elevated relative to the FED’s 2% target. However, the January FOMC can be described as a “dovish hold” and further rate cuts in 2026 are still possible once inflation shows clearer deceleration. FOMC cited its continued confidence that tariffs-induced inflation would be transitory and FED Chair Jerome Powell also noted the ongoing disinflation in services items. In his press conference, Chair Powell further commented that the current funds rate sits at the upper end of the plausible range of neutral and is appropriately set to guide inflation lower.

Hence, we see policy still modestly restrictive and FED retaining an easing bias. Once tariff-driven inflation abates or further labour market cooling signs re-emerge, the door will open for the FED to cut rates. A clearer downtrend in inflation should emerge when tariff-related price pressures fade as higher prices work through inventories and supply chains. The US labour market is currently in a “low hiring, low firing” mode. This tilts up the risk of labour market softness as technological advancement from AI can displace jobs in the short term before the labour market adapts structurally and benefits from higher productivity and wages in the long run.

Outlook on Singapore Economy and SGD-NEER

This year, we expect global growth to ease modestly due to tariffs, but remain supported by fiscal and monetary policies as well as the AI capex cycle. Such “goldilocks” global environment provides a conducive climate for a small open economy like Singapore to thrive. Indeed, according to the Ministry of Trade and Industry (MTI), the Singapore economy expanded by 5.0 % for the whole of 2025.

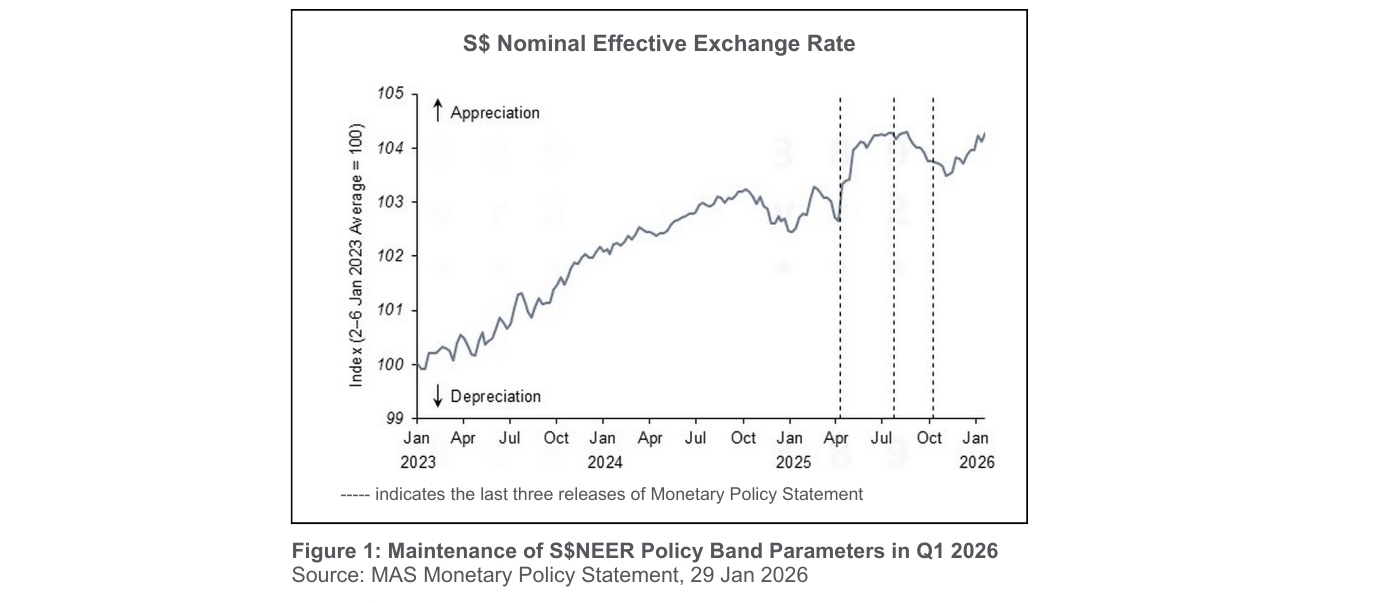

Just in January 2026, the Monetary Authority of Singapore (MAS) had its quarterly Monetary Policy Committee meeting. The MAS announced that it will maintain the prevailing rate of appreciation of the Singapore Dollar Nominal Effective Exchange Rate (S$NEER) policy band with no changes to its width and the level at which it is centred as shown in Figure 1. While this is the third time MAS has held its policy unchanged, the January 2026 MAS monetary policy statement has switched to a hawkish tone from the neutral tone in the same meeting three months ago. In the January 2026 Monetary Policy Statement, MAS’ economic assessment was generally upbeat. MAS expects Singapore’s near-term GDP growth to remain resilient, driven by strength in trade-related sectors underpinned by the global AI-driven capex cycle, steady financial services, and ongoing construction projects. On inflation, MAS has raised its 2026 forecast for headline and core inflation to 1.0-2.0%, from 0.5–1.5% in the October 2025 Monetary Policy Statement. It also added that risks to the growth and inflation outlook are tilted to the upside, as persistently stronger-than-expected GDP growth could lead to higher wage growth and boost consumer sentiment, exacerbating demand-pull inflationary pressures. With a hawkish tone from the January 2026 statement, market participants are expecting the MAS to slightly steepen the SGD-NEER slope at its April policy meeting.

Implication on Singapore Dollar Rates

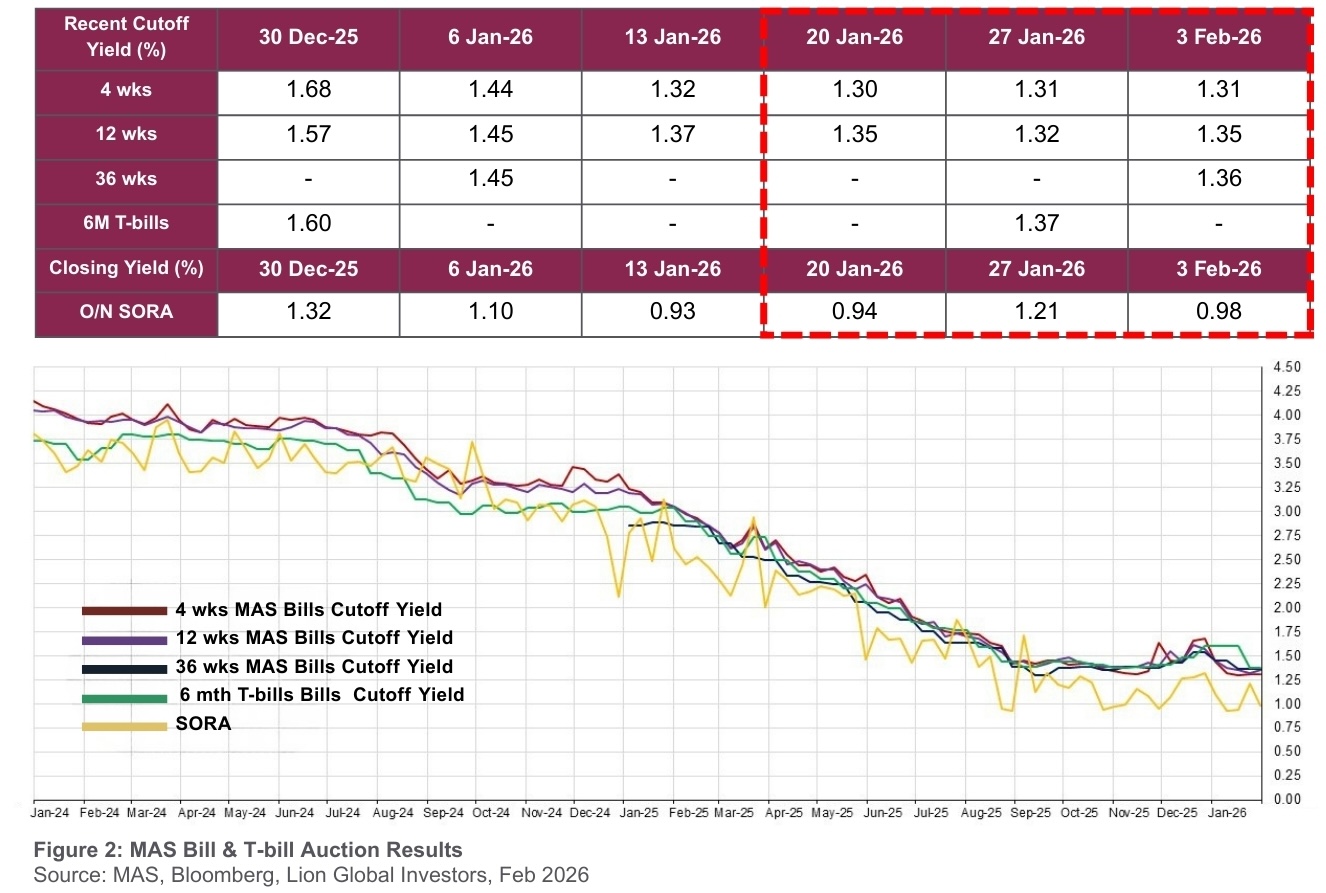

This means that we can expect the S$NEER to continue to hover in the upper end of the S$NEER band until the next MAS meeting in April 2026. This will continue to anchor the relative strength of SGD against its trading partners. When we put the expectation of a strong SGD and probability for further FED rate cuts into the interest-rate-parity relationship, the implication is for SGD short-end interest rates to be anchored at low levels. Since the start of the year, we have seen the auction yields for MAS bills as well as the Singapore Treasury Bills come at below 1.4% as shown in Figure 2 below.

Besides the outlook on MAS’ policy in April 2026, SGD is also benefitting from diversification and safe-haven flows, as Singapore Government Securities (SGS) are rated “AAA” by credit rating agencies. Unlike many countries which face fiscal concerns from having to increase government borrowing to fund fiscal spending, the Singapore Government operates a balanced budget policy and most of the government’s borrowings are not used to fund its expenditure. This means that the bond supply of Singapore Government Securities is likely to be supportive of the market. The 2026 SGS auction calendar that was announced late last year guided for the outstanding amount of SGS in 2026 to grow at a similar pace to 2025.

INVESTMENT IMPLICATIONS

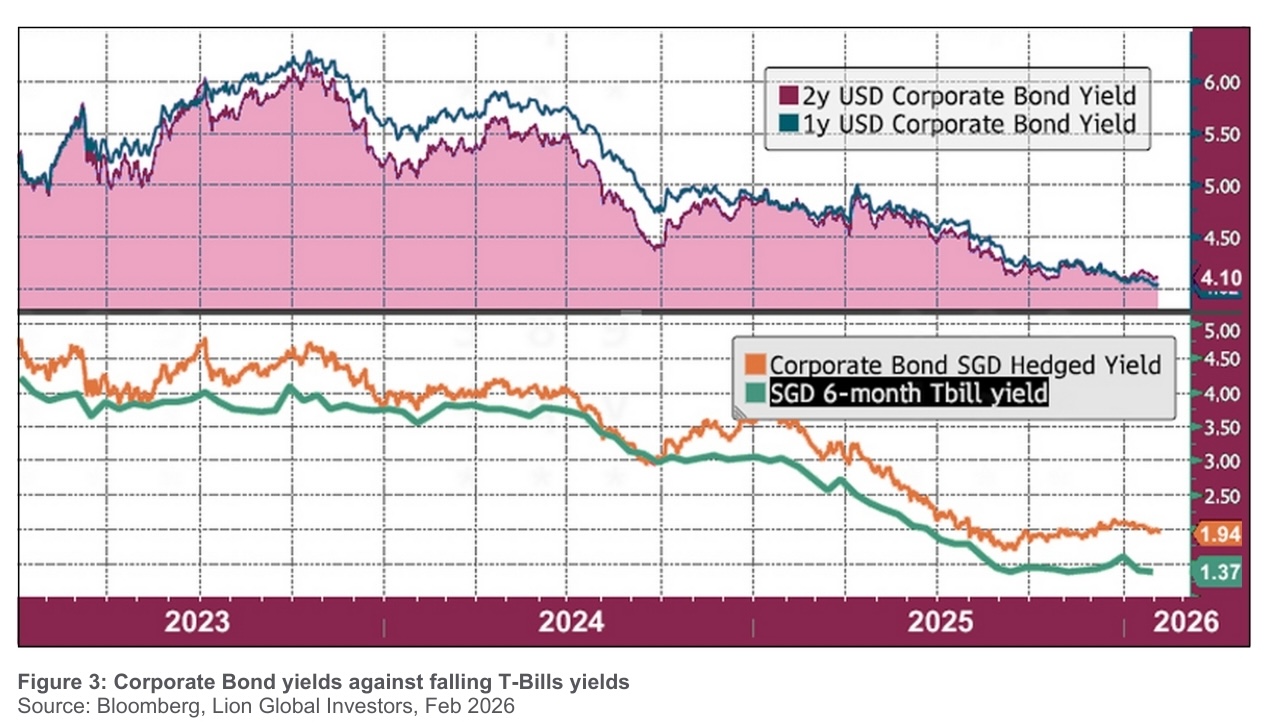

Given declining interest rates offered by fixed deposits and T-bills, we find that a diversified portfolio of corporate bonds will provide SGD-based investors with an interesting investment proposition. This includes both SGD-denominated corporate bonds as well as corporate bonds denominated in other currencies, such as the USD, hedged back to SGD. The current backdrop of resilient economic growth environment and accommodative monetary and fiscal policies globally provides a combination of supportive factors for corporates to maintain or even improve their creditworthiness. Generally, corporate balance sheets are not overly levered, stronger earnings bode well for Debt/EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) ratios, while interest coverage ratios can also see improvement as corporates have moved out from the restrictive high interest rate environment a few years ago. To capture these attractive opportunities from a diverse universe of corporate bonds, investors can look into the suite of liquidity funds offered by Lion Global Investors.

All data are sourced from Lion Global Investors and Bloomberg as at 6 February 2026 unless otherwise stated.