2025 SINGAPORE MARKET UPDATE

The ongoing trade tariff war has created volatility and uncertainty for financial markets, businesses and individuals alike.

President Trump’s latest policies have been polarizing, to say the least. There is a general discomfort over his actions and approach to global issues, leading to valid concerns that policy mis-steps could careen the global economy into a negative spiral.

The other view, perhaps more centrist, is based on incentives. After all, President Trump has a business background, and has every incentive to help businesses; or at least American businesses. A swift resolution to the tariff wars would be beneficial to the American economy, especially as we move into U.S. midterm elections in 2026. President Trump has also argued for the U.S. Federal Reserve to lower interest rates, lending credence to the idea that he aspires for higher equity markets, not lower. The ideal scenario is: should a tariff resolution with China be achieved by the middle of the year, then global growth can resume. No country, the U.S. or China alike, would wish to instigate a global recession. The incentive for all parties is for a swift resolution.

In the near term, we could expect financial markets to remain volatile as negotiations flip-flop. This is a normal and expected process. We could also see global GDP growth turn negative in the middle of the year, causing yet more concerns in the markets. Nevertheless, barring a complete breakdown or protracted negotiations between the U.S. and China, we could look back in time and view the next few months as an opportune time to add to quality companies at attractive valuations.

Even beyond the tariff resolutions, geopolitical tensions could remain a feature of the remainder of this decade. The impact of the tariffs could lead to the re-alignment of global supply chains. Whilst both these trends create global uncertainty, please find below 3 reasons why we feel they could indeed play into the strengths of the Singapore Equity Market and elevate the attractiveness of Singapore Equities as a global asset class.

1. GEOPOLITICAL UNCERTAINTY

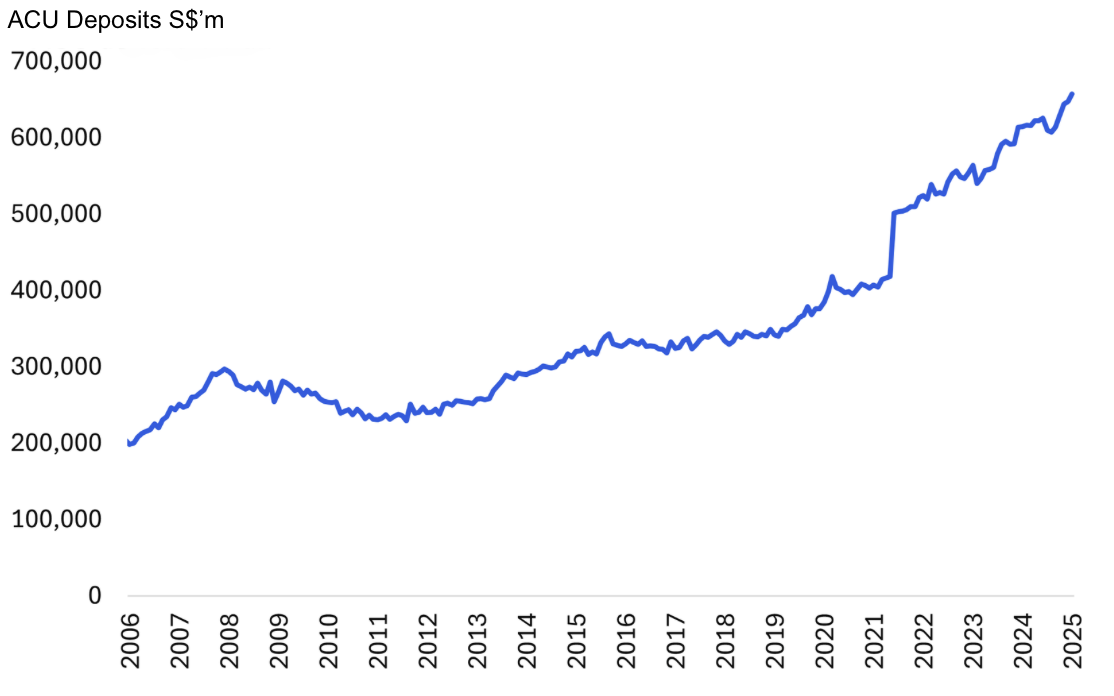

Figure 1: Foreign deposits (measured by Asian Currency Units (ACU)) into Singapore.

Source: Monetary Authority of Singapore, Citi, Lion Global Investors, April 2025

2. SINGAPORE EQUITIES OUTPERFORM DURING PERIODS OF SUPPLY-LED INFLATION

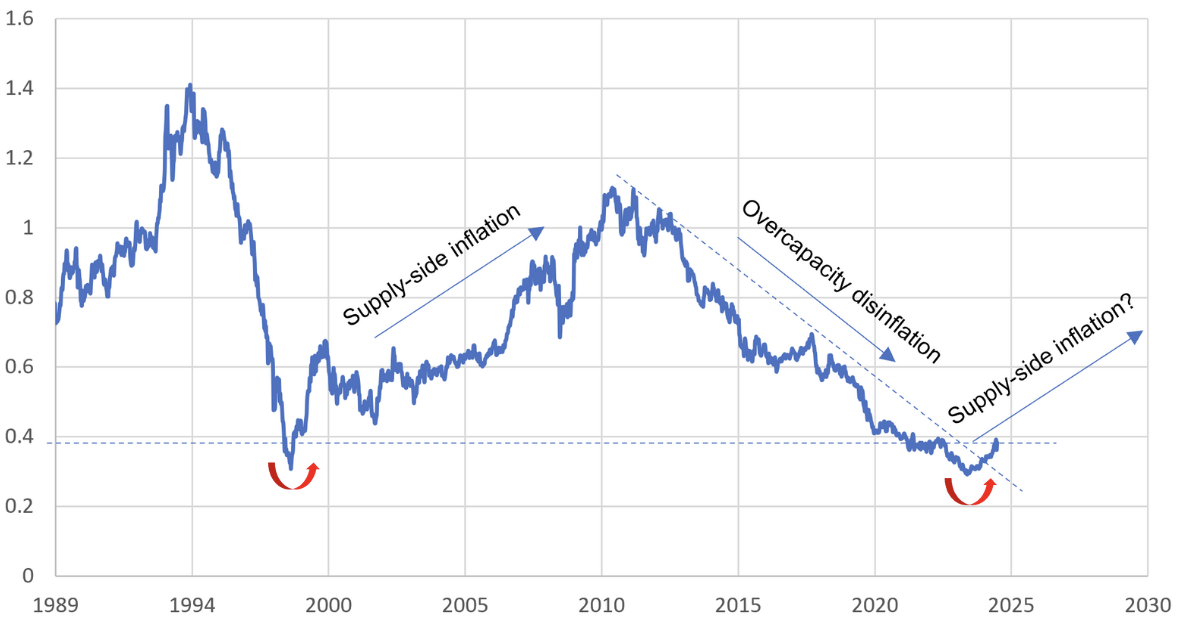

We can observe from Figure 2 that Singapore Equities undergo sustained periods of outperformance and underperformance in response to inflation. From the post Asian Financial Crisis decade of 2000 – 2010, Singapore Equities benefited from being part of the extended regional supply chain from rising Chinese demand. However, the period after the Global Financial Crisis of 2008 brought about slower growth, overcapacity of supply chains and disinflation, leading to underperformance of the Singapore Equities from 2012 – 2023.

We are now observing the start of the outperformance in Singapore Equities since 2024, with supply-chain led inflation as a structural driver. The industrial and technology overcapacity amongst Singapore firms from the prior decade has now given way to industry consolidation, paving the way for more robust industry dynamics. Singapore firms are now poised as geopolitically neutral agents to take advantage of shifting alliances that would inevitably lead to supply chain inflation amidst a mercantalistic, tariff-led global trading environment.

Figure 2: Relative performance of Singapore Equities (MSCI Singapore Index) against global equities (MSCI World Index), constant currency terms.

3. S$5BN EQUITY DEVELOPMENT PROGRAM AND SG60

Prime Minister Lawrence Wong delivered a comprehensive and market-friendly Budget Statement on 18 February 2025. The Budget included equity market-friendly programs such as a S$5 billion equity market development fund to catalyse the vibrancy of the Singapore equity market. This initiative has the potential to drive further interest in Singapore equities over the next couple of years.

Overall, the fundamentals of Singapore equities remain intact. Indeed, the Singapore equity market stands to benefit from geopolitical uncertainty and the implications of tariffs on global supply chain realignment. With the recent correction in Singapore equities, valuations have become more undemanding, supported by attractive and defensible dividends.

All data are sourced from Lion Global Investors and Bloomberg as at 17 April 2025 unless otherwise stated.