Introduction

The LionGlobal All Seasons Funds (Standard and Growth) were set up in 2018 with the aim to generate capital appreciation over the long term by investing primarily in a diversified portfolio of active funds and Exchange Traded Funds (ETFs), across different geographical regions and asset classes. LionGlobal All Seasons Fund (Standard) targets a below average level of portfolio risk (70% Bonds, 30% Equities^) while the LionGlobal All Seasons Fund (Growth) targets an above average level of portfolio risk (30% Bonds, 70% Equities^). The fund charges a low management fee of up to 0.5% p.a. with a total expense ratio* capped at 0.5% p.a. The underlying Lion Global Investors managed funds’ management fees are fully rebated into the LionGlobal All Seasons Fund.

^ This is the typical and projected average asset collection and actual allocations may vary but will remain aligned with investment objectives and strategies.

*The total expense ratio (TER) is the sum of various identified operating expenses charged on an ongoing basis to the fund’s assets as a percentage of the fund’s average net asset value calculated over a 12-month period at the close of the annual and semi-annual financial statements of the fund.

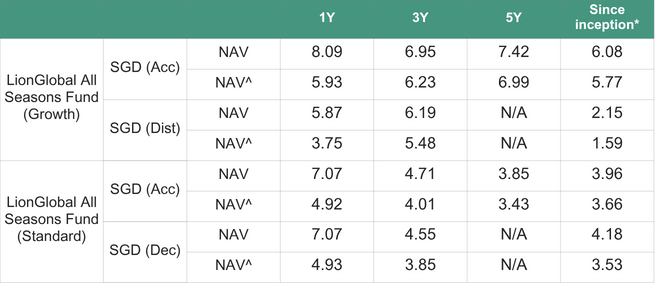

Performance by share class ($)

Source: Lion Global Investors Ltd / Morningstar, as of 31 May 2025

NAV: Data do not include Initial Charge

NAV^: Data include Initial Charge for the respective share classes (where applicable)

Past performance is not necessarily indicative of future performance. Return periods longer than 1 year are annualised.

1Returns are based on a single pricing basis. Dividends are reinvested net of all charges payable upon reinvestment and in respective share class currency terms.

*The Fund Inception dates are 30 July 2018 for LionGlobal All Seasons Fund (Standard) SGD (Acc) and LionGlobal All Seasons Fund (Growth) SGD (Acc); 13 Sep 2021 for LionGlobal All Seasons Fund (Growth) SGD (Dist) and 15 Mar 2022 for LionGlobal All Seasons Fund (Standard) SGD (Dec).

For explanation of additional technical terms, please visit www.lionglobalinvestors.com.

Equities - Market Recovered But Risks Remain

Equity markets have broadly recovered from the significant decline observed around President Trump’s Liberation Day, driven by tariff pause – most notably between the world’s two largest economies, the US and China. However, this reprieve may prove temporary, as tariff uncertainty is likely to persist until a more stable trade policy regime is established. In the US, robust economic activity has been aided in part by front-loaded demand, but business sentiment and consumer confidence have shown signs of weakening. For now, the economy continues to be underpinned by healthy household balance sheets and a resilient labor market.

The recent truce between the US and China has also helped to reduce near-term recession risks. However, equity valuations are expensive following the rally, and corporate earnings growth may moderate as US firms are unable to pass on the full costs in a higher-tariff environment. In Europe, there are nascent signs that the manufacturing sector may be emerging from a prolonged two-year downturn. Policymakers appear to be adopting a more expansionary stance, with medium-term growth expected to benefit from increased defense spending. Nonetheless, the pace and effectiveness of policy execution remain critical to supporting the recovery. Meanwhile, a weakening US dollar is expected to be supportive for Asian equities by lowering the cost of servicing dollar-denominated debt and freeing up capital for investment and spending. In China, leading technology firms have emerged as global contenders to the US’ ‘Magnificent Seven’. The government has also continued to ease monetary policy via lower borrowing rates, and increased capital injections, with room for additional fiscal stimulus if economic growth falls short of the 5% annual target2.

Bonds - US Fiscal Challenges Persist

2 Source: China Economic Update (June 2025), World Bank Group, as of 13 June 2025

3 Source: The Budget and Economic Outlook 2025 to 2035, Congressional Budget Office, as of 13 June 2025.

4 Source: Bloomberg, as of 17 June 2025