Climbing up the ranks as one of the world’s largest economies

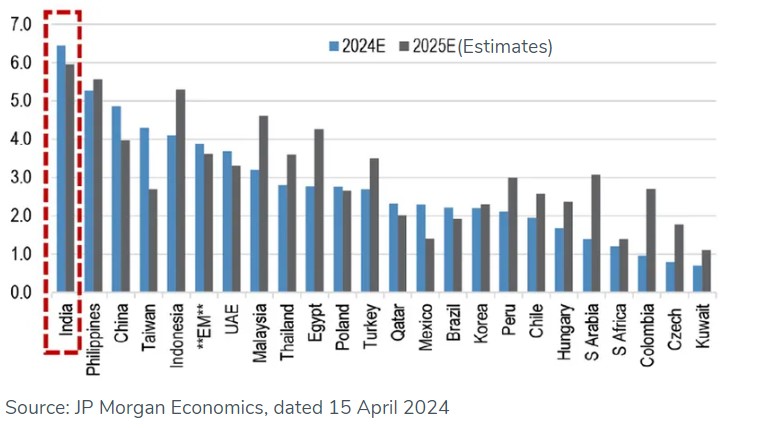

India is set to exit its FY24 with its US$3.6tr GDP, 7.6% growth, placing it as one of the fastest growing large economies in the world. The near-term outlook for the Indian economy remains bright, with forecasts of GDP growth being nudged up to the 7% level as most recent reported numbers come in ahead of expectations. At these growth rates, it is only mathematical to see India leapfrog Japan and Germany, to take its place as the 3rd largest economy in the world by 2027. The high confidence of market forecasters, on such an event, is underpinned by visible factors that have enabled this growth to fructify. These include the benefits of its demographic dividend, an ability to use technology to reach out to a bigger pool of consumers and the government’s reforms that have helped laid the foundation for this period of sustained high growth. Any worries that this year’s national elections might throw up a negative surprise in form of a change of government, looks to have been relegated to a low-probability event, after the Bharatiya Janata Party’s strong showing in regional polls at the end of last year. With policy continuity looking likely, the long-term outlook for India is clearly encouraging even beyond the next 3-4 years.

Forging a divergent growth path

The divergent growth path of India vs. the rest of Emerging Markets or the rest of the world’s large economy, is a well-known phenomenon, by now. The Indian equity markets have delivered good returns for investors in recent years. Capital markets signed off FY24 with a stellar 29%/38% returns in Nifty/MSCI India indices. India’s market capitalisation has reached US$4.4tr, making it the fifth largest in the world. Over the last four years, the MSCI India Index has delivered compounded returns of 26%, albeit from the Covid-inflicted market lows of March 2020. While there is clearly some valuation multiple expansion, one has to appreciate that the Indian market earnings (Nifty) has also delivered fairly solid compounding of ~22% over the same time period, albeit from a depressed base. Although valuations of Indian equities are relatively high, we opine that that alone will not derail a bull market, as long as they are well anchored by stronger growth prospects in a world of lacklustre growth. Afterall, equity investors are growth seekers, and they tend to gravitate towards destinations and stocks that offer premium growth.

Figure 1: India 2024-25 Real GDP growth vs. rest of Emerging Markets

Two reasons for that premium valuation to sustain

We argue that the two ingredients that will keep valuations lofty are:

1) Superior earnings growth

2) Increasing domestic savings pool.

From the perspective of a foreign investor, just as it is difficult to find an alternative equity market that has delivered 20%+ earnings growth in the past four years, it is tough to find an alternative economy that can deliver 6-7% GDP growth ahead, and the likely companion of superior corporate earnings growth. India’s longer-term positive factors have not changed. The external shift of global manufacturing into India, now going by the oft-quoted moniker “China+1”, is in full swing. Industrial capacity expansion creates corporate business opportunities and earnings growth. Industrialisation creates jobs to birth a new middle class. The above supports the ingredient of ‘superior earnings growth.’

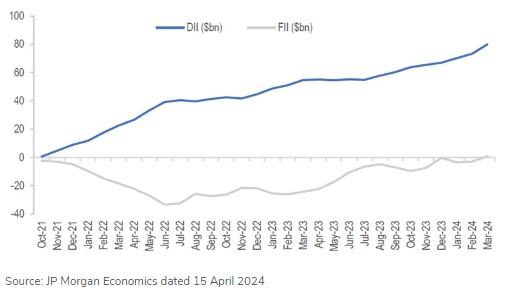

The newer trend that has emerged in the past two years, is the force of the domestic investor on the direction of the equity market. India used to be an emerging market that ebbs and flows on the foreign investors’ appetite for India. Foreign flows are no longer the force that it was. As a growing pool urban affluent accumulate a pile of excess savings, foreign investors have been left behind. The Indian market have outperformed even as total foreign ownership has declined in the market in recent years. Domestic investors tend to invest in names that they are most familiar with – a trend known as domestic bias. China had a period before its current bust, where abundant domestic liquidity chased a limited pool of assets and A-share valuations reached lofty valuations. Eventually, foreign investors are FOMO-ed into the market. We do not think that India is there yet. Part of the reason is that the broader range of listed companies in India, do not have the necessary liquidity to be an alternate repository from China stocks yet. Hence, the premium valuations are only captured in larger, more liquid traditional compounders. We think that foreign investors’ perception of ‘investible’ India, will broaden over time.

Figure 2: Domestic investor (DII) flows outpacing Foreign Investor (FII) outflows.

New themes will crop up

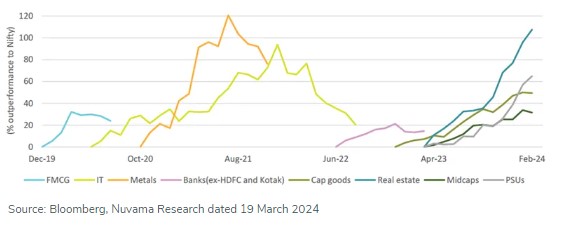

Lastly, the reason we view this rally as one that has legs is because we see a healthy sector rotation in the India market. Traditional wisdom in trying to pick out the top of a structural bull market is market breadth. If the market rally is driven by an increasingly narrow sliver of the market, it implies that the earnings and prospects of the broader market is unhealthy and the risk of a market top increases. For the India market, we have seen the bull market began with IT’s digitisation push. This was then followed by a surge in metals with a narrative of capex revival after a decade of low capex, followed by a “China+1” theme in chemicals and manufacturing. By 2022, the Financials sector had its purple patch as interest rates rise. This gave way to the current rally in real estate, small and mid-caps and government-owned stocks. Each of these themes had underlying earnings drivers to it. One cannot deny that down the liquidity ladder of stocks, some of the companies did rally more on a mythical story rather than an earnings-led development. But, such is the nature of markets. The healthy broadening earnings growth is why we retain our optimism on the longer-term upside of the Indian market.

Figure 3: Sectoral rotation has been the name of the game in India

LionGlobal India Fund

India is one of Asia's most diversified equity markets, and it is poised for healthy growth in the medium to long term due to its strong economic outlook. The LionGlobal India Fund aims for medium to long-term capital appreciation by investing in India equities and equity-related instruments. We are overweight (OW) in Consumer Discretionary, Media and Autos and underweight (UW) in IT Services, Industrials and Financials.

All data are sourced from Lion Global Investors and Bloomberg as of 15 April 2024 unless otherwise stated.