The investment objective of the Fund is to track as closely as possible, before fees and expenses (including but not limited to hedging costs where applicable), the performance of the LBMA Gold Price* AM.

The Fund is backed by investment-grade gold bars with a minimum fineness of 99.5%, meeting LBMA standards1.

- Gold bars are uniquely identifiable and segregated under the Fund’s assets

- No gold derivative exposure

1LBMA (LONDON BULLION MARKETS ASSOCIATION) IS THE GLOBAL TRADE ASSOCIATION THAT SETS INTERNATIONAL STANDARDS FOR GOLD BULLION.

Singapore is globally recognised for its strong rule of law and domestic political stablity.

- Stable foreign relations

- Safe from natural disasters

- No history of gold confiscation since the country’s founding in 1965

The gold is vaulted in Le Freeport in Singapore, a secure storage facility with 24/7 security.

- Electronic personnel monitoring, CCTV surveillance and armed guards

The allocated physical gold is insured to its full value against loss, theft and damage whilst in custody and in transit*.

*Standard exclusions apply to scenarios such as war, chemical or nuclear attacks.

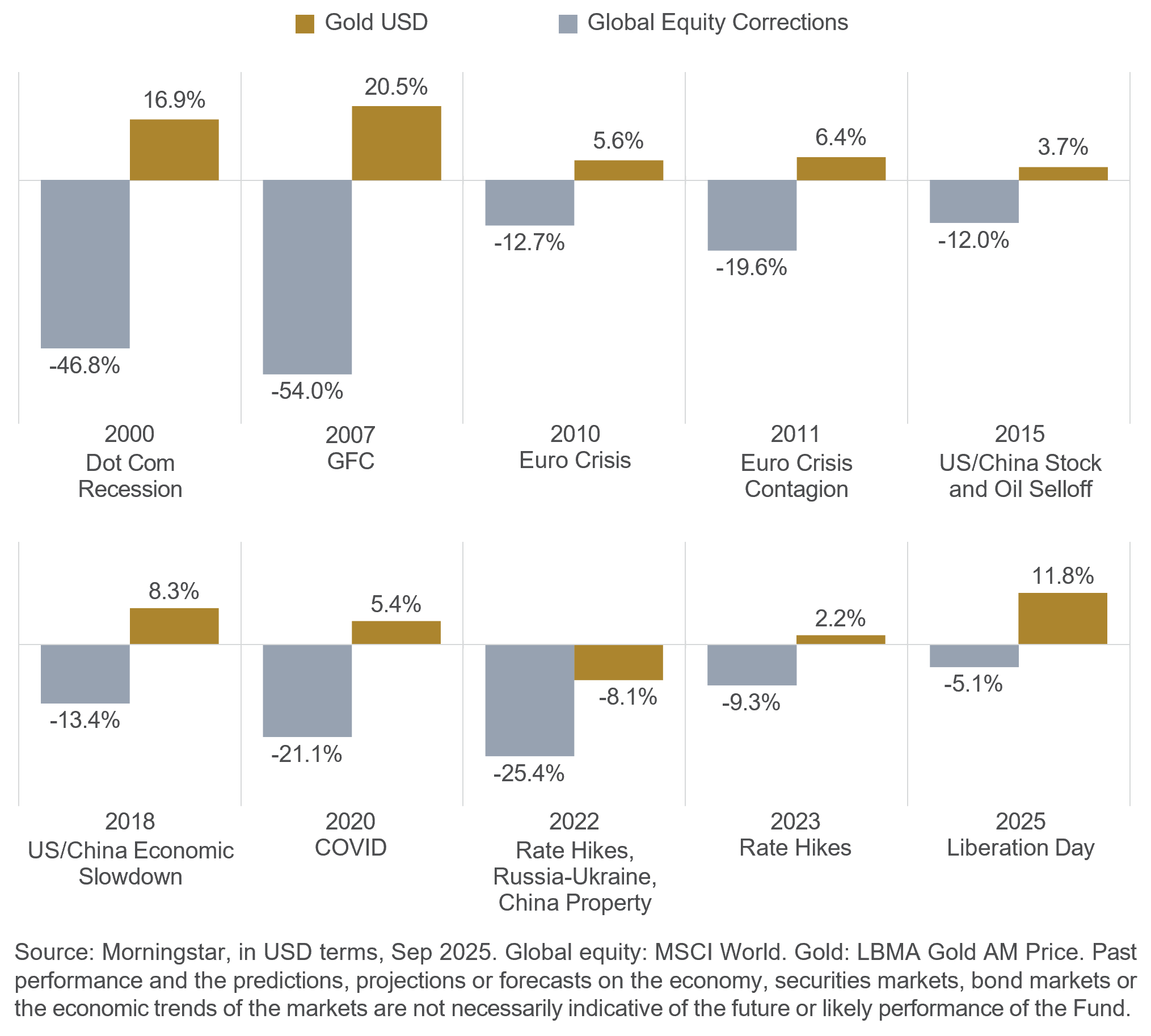

- Safe-haven assets may retain or even increase in value during periods of market crisis

- Since 2000, global equity markets have experienced 10 major crises, including financial crises, interest rate volatility, sovereign debt crises, wars and speculative bubbles

- Gold generated a positive return in 9 crises

- Gold outperformed equities in 2022, declining less than global equities

- Gold’s share of global reserves has risen, while the USD share has declined

- The value of gold in global reserves has increased more than ninefold since 2000

- The share of USD in global reserves has declined from 71% to 58%

- The trend of central bank diversification coincides with increased central bank gold buying

- Central bank gold buying supports both gold demand and prices

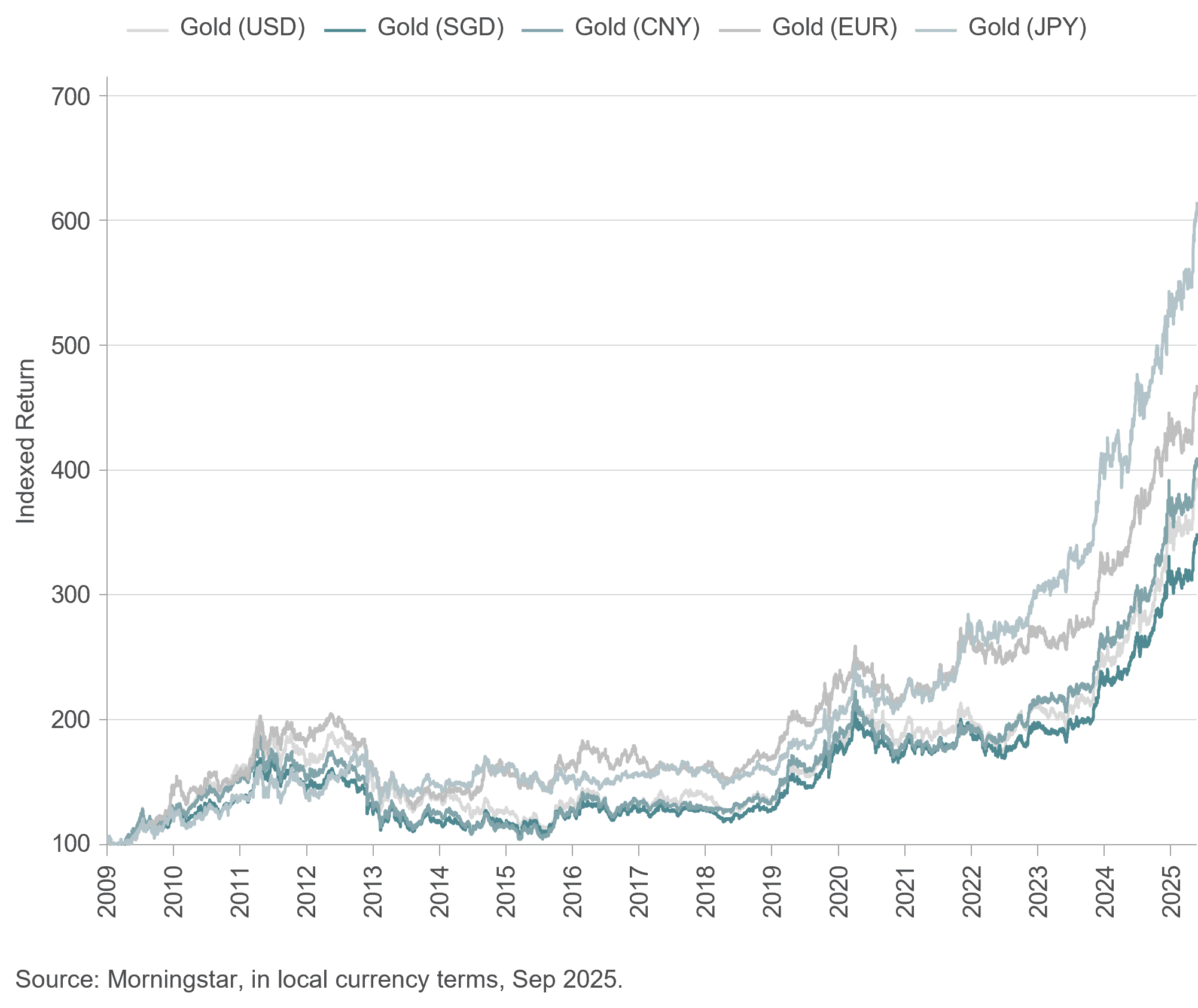

- Gold’s safe-haven status endures across multiple currencies

- Gold has appreciated against both developed market and Asian currencies

- Historically, gold has served as a hedge against weakness of fiat currencies

- Gold’s safe-haven and fiat currency hedge qualities help preserve long-term wealth globally

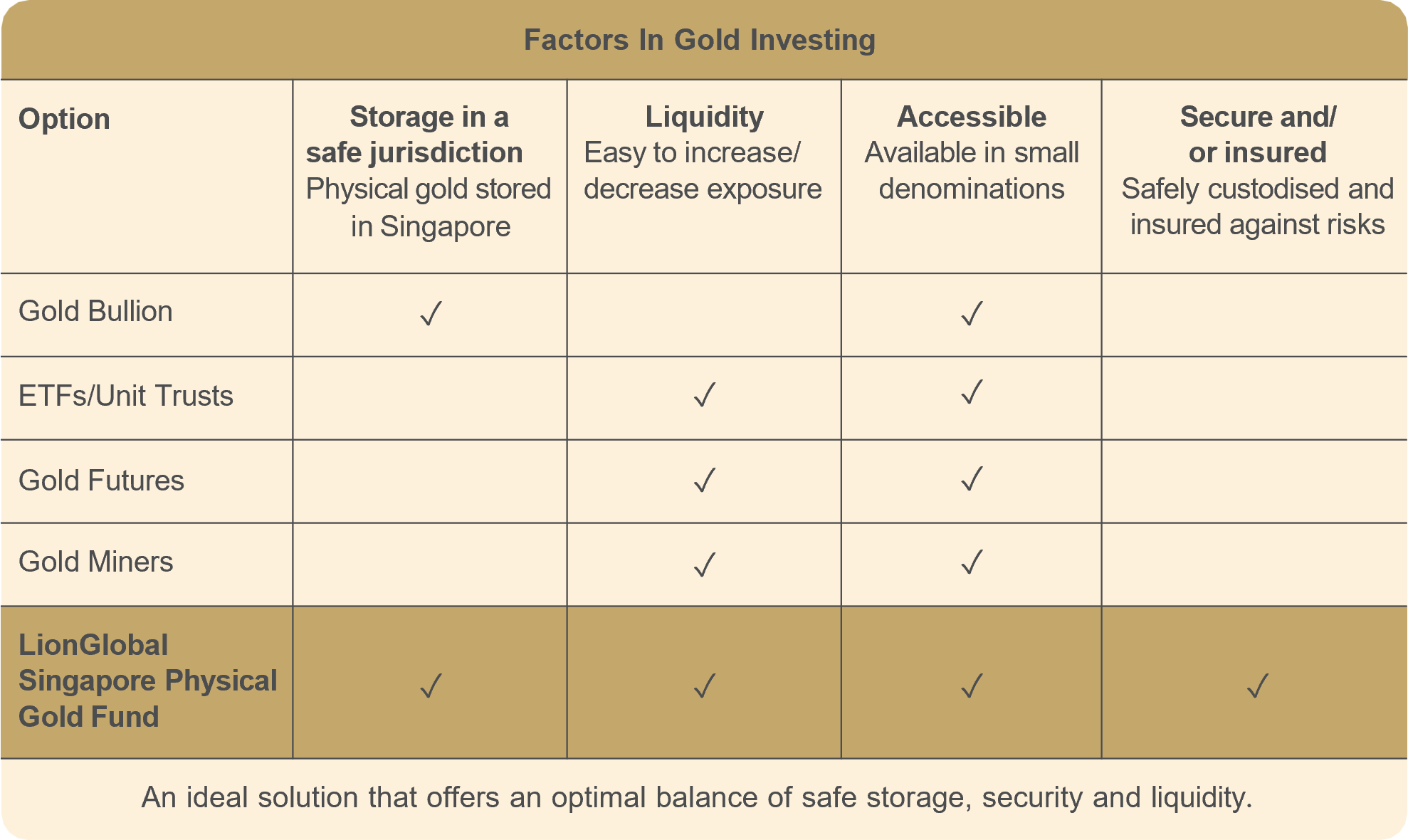

The Fund provides gold price exposure by tracking the LBMA Gold Price AM and is Singapore’s first gold fund with physical gold custodised entirely in Singapore.

The Fund offers easy access to gold ownership, securely stored in a stable location, and fully insured.

|

Easily accessible |

Buying gold in smaller denominations incurs significant bid-ask spreads. With the Fund, you can invest in gold with as little as S$1000 for most share classes (and S$1 for the MariBank share class). |

|

Securely stored |

Private custody of gold often comes with risk of theft, loss or damage. The Fund vaults all its gold with Standard Chartered Bank in a secure vault with 24/7 institutional security. |

|

Stable location |

Many gold funds have their vaults located in US or UK, which are foreign jurisdictions with limited means of repatriation. The Fund’s allocated gold is fully vaulted in Singapore, a stable jurisdiction, free from natural disasters, with strong rule of law, and stable foreign relations. |

|

Fully insured |

Unlike many gold funds, the Fund’s gold is fully insured by the custodian against the loss or theft of, and damage to the gold in the allocated account while such gold is in the custodian’s custody and also in transit |

The Fund invests only in Gold, which are gold bars of a minimum fineness of 99.5% that have been produced by refiners on the LBMA Good Delivery List and are compliant with the LBMA Good Delivery Rules.

The London Bullion Market Association (now known simply as LBMA), established in 1987, is the international trade association representing the global Over The Counter (OTC) bullion market.

Allocated gold is ringfenced / segregated in the vault with a unique identifier. The holder of the account has ownership and legal title to the gold held within. Unallocated gold is a contractual claim to a certain pool of gold that is not uniquely identifiable in the Custodian’s vault.

The purpose of the Unallocated account is to facilitate subscriptions and redemptions.

Singapore offers a strong legal framework and stable geopolitical environment. As a recognised international financial and gold trading hub, Singapore is considered a secure and reliable jurisdiction for gold storage.

The Sub-Custodian, Standard Chartered Bank UK, will conduct routine inspections at least annually on a risk-based approach including security of premises, vault processes and inventory checks. In addition, PricewaterhouseCoopers (the Fund’s auditors) will conduct annual inspections with a reconciliation of the Gold against the Custodian’s and Administrator’s records.

1. Singapore-registered Unit Trusts and Singapore-listed ETFs are not subject to estate tax

2. Singapore does not impose capital gains tax on investment gains

Disclaimer – LionGlobal Singapore Physical Gold Fund

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. It is for information only, and is not a recommendation, offer or solicitation for the purchase or sale of any capital markets products or investments and does not have regard to your specific investment objectives, financial situation, tax position or needs. You should read the prospectus and Product Highlights Sheet of the LionGlobal New Wealth Series II - LionGlobal Singapore Physical Gold Fund (the “Fund”) which are available and may be obtained from Lion Global Investors Limited (“LGI”) or any of its distributors, for further details including the risk factors and consider if the Fund is suitable for you and seek such advice from a financial adviser if necessary, before deciding whether to invest in the Fund. Applications for units in the Fund must be made on forms accompanying the prospectus.

An investment in a precious metals fund carries risks of a different nature from other types of collective investment schemes which invest in transferable securities and a precious metals fund may not be suitable for persons who are adverse to such risks. An investment in a precious metals fund is not intended to be a complete investment programme for any investor. As a prospective investor, you should carefully consider whether an investment in a precious metals fund is suitable for you, taking into account, your investment objectives, risk appetite and the potential price movements of precious metals. You are responsible for your own investment choices. Investments in the Fund are not obligations of, deposits in, guaranteed or insured by LGI or any of its affiliates and are subject to investment risks including the possible loss of the principal amount invested. The performance of the Fund is not guaranteed and the value of units in the Fund and the income accruing to the units, if any, may rise or fall. Past performance, payout yields and payments as well as any predictions, projections, or forecasts are not necessarily indicative of the future or likely performance, payout yields and payments of the Fund. Any extraordinary performance may be due to exceptional circumstances which may not be sustainable. Any dividend distributions, which may be either out of income and/or capital, are not guaranteed and subject to LGI’s discretion. Any such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value of the Fund. There can be no assurance that any of the allocations or holdings presented will remain in the Fund at the time this information is presented. Any information (which includes opinions, estimates, graphs, charts, formulae or devices) is subject to change or correction at any time without notice and is not to be relied on as advice. You are advised to conduct your own independent assessment and investigation of the relevance, accuracy, adequacy and reliability of any information or contained herein and seek professional advice on them. No warranty is given and no liability is accepted for any loss arising directly or indirectly as a result of you acting on such information. The Fund may, where permitted by the prospectus, invest in financial derivative instruments for hedging purposes or for the purpose of efficient portfolio management. The Fund's net asset value may have higher volatility due to its narrower investment focus (primarily in Gold (as defined in the prospectus)), when compared to funds with more diversified portfolios.

LGI, its related companies, their directors and/or employees may hold units of the Fund and be engaged in purchasing or selling units of the Fund for themselves or their clients. This publication is issued in Singapore ©Lion Global Investors® Limited (UEN/ Registration No. 198601745D). All rights reserved. LGI is a Singapore incorporated company, and is not related to any corporation or trading entity that is domiciled in Europe or the United States (other than entities owned by its holding companies).

Disclaimer - ICE Benchmark Administration Limited

THE LBMA GOLD PRICE, WHICH IS ADMINISTERED AND PUBLISHED BY ICE BENCHMARK ADMINISTRATION LIMITED (IBA), SERVES AS, OR AS PART OF, AN INPUT OR UNDERLYING REFERENCE FOR LIONGLOBAL SINGAPORE PHYSICAL GOLD FUND.

LBMA GOLD PRICE IS A TRADE MARK OF PRECIOUS METALS PRICES LIMITED, AND IS LICENSED TO IBA AS THE ADMINISTRATOR OF THE LBMA GOLD PRICE. ICE BENCHMARK ADMINSTRATION IS A TRADE MARK OF IBA AND/OR ITS AFFILIATES. THE LBMA GOLD PRICE AM, AND THE TRADE MARKS LBMA GOLD PRICE AND ICE BENCHMARK ADMINISTRATION, ARE USED BY LION GLOBAL INVESTORS LIMITED WITH PERMISSION UNDER LICENCE BY IBA.

IBA AND ITS AFFILIATES MAKE NO CLAIM, PREDICATION, WARRANTY OR REPRESENTATION WHATSOEVER, EXPRESS OR IMPLIED, AS TO THE RESULTS TO BE OBTAINED FROM ANY USE OF THE LBMA GOLD PRICE, OR THE APPROPRIATENESS OR SUITABILITY OF THE LBMA GOLD PRICE FOR ANY PARTICULAR PURPOSE TO WHICH IT MIGHT BE PUT, INCLUDING WITH RESPECT TO LIONGLOBAL SINGAPORE PHYSICAL GOLD FUND. TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ALL IMPLIED TERMS, CONDITIONS AND WARRANTIES, INCLUDING, WITHOUT LIMITATION, AS TO QUALITY, MERCHANTABILITY, FITNESS FOR PURPOSE, TITLE OR NON-INFRINGEMENT, IN RELATION TO THE LBMA GOLD PRICE, ARE HEREBY EXCLUDED AND NONE OF IBA OR ANY OF ITS AFFILIATES WILL BE LIABLE IN CONTRACT OR TORT (INCLUDING NEGLIGENCE), FOR BREACH OF STATUTORY DUTY OR NUISANCE, FOR MISREPRESENTATION, OR UNDER ANTITRUST LAWS OR OTHERWISE, IN RESPECT OF ANY INACCURACIES, ERRORS, OMISSIONS, DELAYS, FAILURES, CESSATIONS OR CHANGES (MATERIAL OR OTHERWISE) IN THE LBMA GOLD PRICE, OR FOR ANY DAMAGE, EXPENSE OR OTHER LOSS (WHETHER DIRECT OR INDIRECT) YOU MAY SUFFER ARISING OUT OF OR IN CONNECTION WITH THE LBMA GOLD PRICE OR ANY RELIANCE YOU MAY PLACE UPON IT.

.png)

.png)