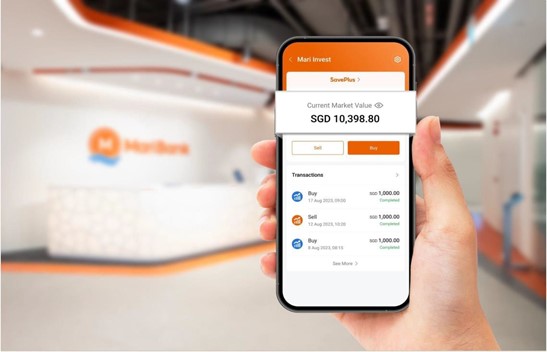

SINGAPORE, 3 OCTOBER 2023 – MariBank, in partnership with Lion Global Investors, today launched Mari Invest, an investment account designed for consumers seeking simple and rewarding ways to grow their wealth. Mari Invest is the first investment account by a bank in Singapore to provide instant cash out1.

Making Investing Simple and Rewarding

Mari Invest is designed to make investing simple, by removing the traditional barriers to investing, such as high minimum investment amounts, sales or platform charges and lengthy lock-in periods with long redemption timelines. Investors can start investing with just S$1 with great flexibility, and withdraw their investments instantly in cash anytime, subject to daily caps and limits1.

Mari Invest is an account that offers access to investment product(s), including the Lion-MariBank SavePlus fund. The Lion-MariBank SavePlus fund comprises mainly MAS Bills (around 60%) and high-quality bond funds, enabling investors to participate in potentially higher yields compared to SGD fixed deposits2, while keeping overall portfolio risk low.

The Lion-MariBank SavePlus fund is offered in collaboration with MariBank’s fund house partner, Lion Global Investors (LGI), one of the largest asset management companies in Southeast Asia with more than 37 years of investment expertise.

Zheng Yudong, CEO of MariBank, said that MariBank is providing an alternative to consumers who are seeking higher returns on their spare cash or looking for easier access to investment instruments such as MAS Treasury Bills, and value the ability to instantly cash out their investments.

“We know that consumers today want to grow their wealth but can find the range of options overwhelming. That's where Mari Invest comes in. We made it simple and accessible, allowing anyone to start investing, grow their wealth, and help them on their journey to secure their financial future.”

Teo Joo Wah, CEO of Lion Global Investors, said the partnership demonstrates LGI’s ability to build solutions to help address the liquidity expectations of digital bank clients. The combined offering with MariBank, a digital bank, makes it extremely convenient and seamless for investors as it will be deeply integrated with MariBank’s banking solutions.

“The collaboration with MariBank validates the demand for a simple and effective approach to liquidity management. This product is an expansion of our product range and demonstrates our capabilities in providing innovative and democratized investment solutions for retail investors through a digital backbone.”

MariBank offers a suite of simple and attractive offerings and is rolling out its banking products to consumers beyond Sea’s ecosystem.

Mari Invest complements MariBank’s flagship savings product, Mari Savings Account providing simple and rewarding offerings for users to manage their finances.

The Mari Savings Account offers 2.88%3 p.a. interest, paid daily, without the need to fulfill any additional conditions such as salary crediting or minimum spend.

Consumers may enjoy the benefits of both products by earning daily interest on balances in the Mari Savings Account, and invest through the seamless transfer of funds to the Mari Invest.

Both products are now available to eligible users in Singapore. Consumers can sign up for a Mari Savings Account and Mari Invest by downloading the MariBank App from Apple’s App Store and Google Play Store.

Disclaimer

The contents in this press release do not constitute the distribution of any information or the making of any offer or solicitation to anyone in any jurisdiction in which such distribution or offer is not authorized or to any person to whom it is unlawful to distribute such contents or make such an offer or solicitation. The information in this press release is intended for general circulation and/or discussion purposes only, and shall not be considered or construed as an offer, recommendation, inducement, solicitation or investment or financial advice to buy or sell or otherwise transact in any investment and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. Investors should read the prospectus and product highlights sheet of the investment fund, available from Maribank or Lion Global Investors Limited, and consider if the fund is suitable for them before investment.

Investments involve risks including the possible loss of the principal amount invested.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

1Instant cash out limit is currently S$10,000 per investor daily and subject to availability.

2This is not to suggest that the fund is comparable to a fixed deposit in nature. It is a different investment product from a fixed deposit as it has different risk – return characteristics and offers features different from a fixed deposit such as higher liquidity, more flexibility in terms of initial and incremental investments. Unlike a passive investment in fixed deposits, it would also be of higher risk with higher volatility of returns compared to fixed deposits.

3Rates are accurate as at point of publishing. All rates are for information only and subject to change without prior notice. Promotional interest rate of 2.88% p.a. is effective till 31 December 2023. Prevailing base rate of 2.50% p.a. shall apply thereafter. Mari Savings Account has a maximum deposit capped at S$75,000. T&Cs Apply.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$75,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

About MariBank

MariBank (Co Reg No. 202106516C) is a digital bank wholly owned by Sea Limited and licensed by the Monetary Authority of Singapore (MAS). The Bank aims to support the banking needs of digital natives and small businesses in Singapore, through the provision of simple and purpose-built banking products.

About Lion Global Investors Limited

Lion Global Investors Limited (Co Reg No. 198601745D) is a part of Great Eastern Holdings and a member of the Oversea-Chinese Banking Corporation Limited (OCBC) Group. Established since 1986, it is a leading and one of the largest asset management companies in Southeast Asia, uniquely positioned to provide Asian equities and fixed income strategies and funds to both institutional and retail investors. As at 30 June 2023, our assets under management (AUM) stands at S$68.8 billion (US$50.8 billion). For more about Lion Global Investors Limited, please visit: www.lionglobalinvestors.com